Researchers Develop a Soft Battery That Has the Consistency of Toothpaste

Devices are often limited by the bulkiness of their batteries—but what if we could shape the batteries into whatever form we want?

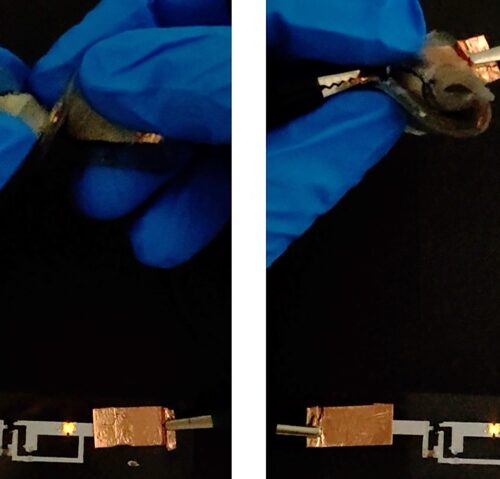

The Li-ion batteries that power everything from smartphones to electric cars are usually packed in rigid, sealed enclosures that prevent stresses from damaging their components and keep air from coming into contact with their flammable and toxic electrolytes. It’s hard to use batteries like this in soft robots or wearables, so a team of scientists at the University California, Berkeley built a flexible, non-toxic, jelly-like battery that could survive bending, twisting, and even cutting with a razor.

While flexible batteries using hydrogel electrolytes have been achieved before, they came with significant drawbacks. “All such batteries could [only] operate [for] a short time, sometimes a few hours, sometimes a few days,” says Liwei Lin, a mechanical engineering professor at UC Berkeley and senior author of the study. The battery built by his team endured 500 complete charge cycles—about as many as the batteries in most smartphones are designed for.

“Current-day batteries require a rigid package because the electrolyte they use is explosive, and one of the things we wanted to make was a battery that would be safe to operate without this rigid package,” Lin told Ars. Unfortunately, flexible packaging made of polymers or other stretchable materials can be easily penetrated by air or water, which will react with standard electrolytes, generating lots of heat, potentially resulting in fires and explosions. This is why, in 2017, scientists started to experiment with quasi-solid-state hydrogel electrolytes.

Emily Najera for BI

In the high desert 25 miles east of Reno, Gooseberry Mine is etched into the dusty Nevada hills. Until 1990, gold was dug out of the ground here. Now it's mostly abandoned.

In late March, I stood a few hundred yards away in a makeshift chemistry lab few people have been allowed to enter. My tour guide, Adam Kirby, a project manager at Redwood Materials, held up a small capsule containing dark powder.

"Black gold," he said, smiling.

The substance is known as Cathode Active Material, or CAM, a combination of metals and minerals that makes up roughly 60% of the value of EV batteries and 15% of the entire price of an electric vehicle.

Oil is the original black gold, of course. This has powered automobiles for a century. Now, though, EVs are steadily replacing the internal combustion engine with what Tesla and the rest of the industry hope is a more sustainable alternative.

For this to really happen, we must recycle the big battery packs inside all these EVs. Redwood Materials, run by Tesla cofounder JB Straubel, is building North America's biggest battery recycling operation. And CAM is the company's next big bet.

Emily Najera for BI

Straubel has been hacking away at this problem for almost a decade. Since Redwood was founded in 2017, the startup has raised about $2 billion from big investors, including Fidelity, Goldman Sachs, Baillie Gifford, and Amazon.

Today, Redwood recycles more than 70% of all the lithium-ion batteries in North America. If you've ever handed old laptops or smartphones to a recycling center in the US or Canada, it's likely they ended up on a giant lot in front of Redwood Materials' 300 acre desert campus.

The company carefully heats these old batteries to just the right temperature to tease out the base ingredients, which include nickel, manganese, cobalt, and lithium. By themselves, these metals are valuable and Redwood has generated hundreds of millions of dollars in revenue by selling this raw material into the EV supply chain.

The next step for the company is combining this into CAM, which is a lot more valuable. Hence the name: new black gold. Instead of digging it up, Redwood conjures it into being through chemistry at industrial scale.

John B. Carnett/Bonnier Corporation via Getty Images

It's an expensive and technically complex bet for Redwood, Straubel, and his investors. While driving down from the lab with Kirby, the project manager, we passed a building under construction that was so huge it made the nearby earth-moving trucks look like toys. This will house most of the full-scale CAM production process, featuring a heated conveyor belt more than 150 feet long.

"Things like Redwood are multibillion-dollar capex, ambitious projects. You must back people with experience and gravitas who can execute," said Chris Evdaimon, an investment manager at Baillie Gifford, who also visited the site recently.

"To raise equity and debt, while having the trust of governments," he added, "not many people can pull this off."

When I got back down the hill, I was ushered into the main Redwood office building on campus and met Chief Commercial Officer Cal Lankton in the "Nickel" office (next to the "Manganese" and "Lithium" rooms, of course).

He recounted how Redwood got started through a surprising revelation: The ingredients of lithium-ion batteries can be reused over and over. Unlike the original black gold, these materials don't go up in smoke or wear out.

Redwood Materials

"That was the foresight on JB's part," Lankton said. "That's what differentiates this automotive transformation from previous ones — the batteries themselves are infinitely recyclable."

Redwood's processes can now recover about 98% of the critical minerals from batteries. The problem is that once this stuff has been salvaged, it must be shipped overseas, mainly to China, where it's refined and combined into useful products such as CAM.

By the time this material goes into a new battery cell in a US gigafactory, it has traveled roughly 50,000 miles from being shipped to Asia and then back again, according to Baillie Gifford's Evdaimon.

That's massively inefficient. If the US and Europe really want to meet lofty goals such as having half of cars being electric by 2030, a homegrown industry is needed. "Redwood Materials is essential for this," Evdaimon added.

Redwood Materials

Redwood's solution is what Lankton calls a "circular battery value chain," and he says no one is doing this at scale yet in the Western world.

The start of Redwood's circle begins with getting as many used batteries as possible. This includes production scrap from gigafactories, such as the ones Panasonic runs to supply Tesla, but also many other sources.

Redwood has massively expanded the number of ways it gets old batteries via contracts with companies such as Toyota, VW, Ford, GM, Amazon, and BMW. Redwood often pays to access this supply, betting it can make more money by turning this unwanted, hazardous scrap into the new black gold.

When you walk into Redwood Materials' high desert office in Nevada, there's even a black letterbox where visitors and staff can drop off old laptops and phones — or anything else that has a rechargeable battery.

The company now handles more than 20 gigawatt hours worth of lithium-ion batteries a year, the equivalent of almost 1.6 billion cellphones.

The result is a dusty lot full of batteries in front of the Redwood office that stretches halfway to the horizon. Kirby drove me around to see the different types of batteries arranged in squares with gaps of a few yards to prevent runaway fires.

Some of these batteries still have a charge, so they must sit outside to shed this remaining electricity so they're safe to process.

Emily Najera for BI

I wanted to snap photos, but Kirby said no up-close pics. Some partners don't want their old gear exposed to the public like this. Although, I did see a battery from a Hummer EV that was so big it took up a sizable portion of one storage square.

Then, we drove up the hill through Redwood's campus to near the top. There, batteries are carefully heated up to release the minerals and metals.

Some volatile organic compounds are released by this part of the process. These and other unwanted by-products are processed through a winding maze of giant tubes and collected and cleaned with what are essentially huge HEPA filters, according to Kirby. It looked like a giant Rube Goldberg machine, sparkling in the desert sun.

Emily Najera for BI

Kirby said some other battery recycling companies don't spend much time or money on this painstaking step, making their facilities less environmentally friendly.

Next, a hydrometallurgy process refines and purifies the metals, minerals, and chemicals that are needed for CAM.

"Redwood's equipment was bought from other places, but they have made many adjustments. This is truly novel," said Baillie Gifford's Evdaimon. "There are a hundred small things they've done to tweak and upgrade, and collectively, this makes Redwood the most efficient and innovative recycler for this industry in the Western world."

Once these ingredients have been isolated, they would typically be shipped to Asia. Starting in early 2026, Redwood will instead combine them into CAM inside the massive white campus building that's being finished as I write this. (There's enough space to build several more of these facilities on site, depending on how Redwood's big bet goes).

Emily Najera for BI

Redwood estimates that North America will need 12 million tonnes of CAM by 2030, none of which is currently produced at commercial scale outside of China, Korea, and Japan. The company expects to be the first in North America.

In the coming years, Redwood aims to churn out 100 gigawatt hours worth of CAM per year. That would enable production of enough batteries to power 1.3 million EVs annually.

"What's beautiful about this business: So many partners and plants will take anything that Redwood makes right now. These ingredients are already in demand," said Evdaimon. "And the more processes you add up the value chain, the more valuable your product gets and the better the profit margins are. There are a lot of processes that Redwood is adding."

Reclaiming nickel, cobalt and other battery ingredients, rather than digging up virgin material from dirty, dangerous mines, is a heck of a lot more efficient. According to Redwood Materials, it uses 80% less energy, generates 70% fewer CO2 emissions, and requires 80% less water.

Actually making good CAM, though — up to the high specifications of battery manufacturers — is really hard.

You must get just the right combination of nickel, manganese, cobalt, and lithium, along with tiny amounts of rare-earth minerals and other ingredients. That forms a lattice structure that has to be strong but also allows the free movement of lithium ions back and forth between the battery's cathode and anode as it charges and discharges electricity.

"At the end, it literally looks like a black powder that we put in big plastic bags and ship to the customer," Lankton said. "But the work that goes into making this is incredibly technical."

There are three stages of Redwood's CAM journey. The first is the lab that I was allowed into. This is where the core chemical processes are devised and tested on a small scale.

Nearby is a demonstration plant that is a scaled-down version of Redwood's ultimate facility. Here, the company operates the same equipment and processes, such as rotating kilns, to prove its CAM production methods work consistently.

The final stage is doing all this on a massive scale in the giant CAM building down the hill from the lab and demo plant.

Emily Najera for BI

"We're in that middle phase, but we've derisked a lot of that final step," Lankton told me. "That's why we have a high degree of confidence in our ability to achieve our targets."

So confident, in fact, that Redwood already has multibillion-dollar contractual offtake agreements with Toyota and Panasonic for its CAM.

This endeavor is not just technically complex, though. There are other risks when you're competing with China's manufacturing might.

Redwood used to make copper foil, too, which is the main ingredient for the anode in batteries. However, Chinese companies began churning this out in massive quantities, and prices plummeted.

Lankton said blood, sweat, and quite a bit of capital went into the copper foil business, and he credited Straubel with the ability to make the painful decision to pause this part of the business.

"That is, perhaps, a point of pride to differentiate us from our peers," Lankton added. "We're not dogmatic; we're not going to take a business plan and just do it until we think it works and run ourselves into the ground."

In March, Northvolt, a European battery recycling startup, went bankrupt after chewing through $15 billion in funding.

Lankton said he admired Northvolt's ambitious plans but said the company may have gone too far by trying to make full batteries itself rather than being just a supplier of materials like Redwood.

While Northvolt's demise paints a dour picture for battery recycling, other factors may be playing into Redwood's hands.

The Inflation Reduction Act from 2022 has big incentives for US battery production. And this year, Donald Trump's tariff barrage favors domestic manufacturing.

Being the first major CAM producer in the US is looking like a well-timed initiative right now. But Lankton said Redwood isn't resting on its laurels.

"Why should someone want to buy Redwood's CAM?" he asked me, rhetorically, in the company's Nickel office.

Firstly, Redwood has to be competitive on price globally, irrespective of incentives, tariffs, or other artificial factors.

Second, the company must have the technical prowess to pull this off. "There's hardcore particle engineering that goes into this CAM," Lankton explained. "It has to be consistent with anything else one of our customers can buy. So we have to technically meet or exceed those specifications."

Then, finally, he conceded that there is value in having a reliable, sustainable, secure US source of battery material as questions swirl about the future of global trade.

"But if number one and number two aren't true, no one's gonna buy Redwood's CAM," he warned.

Chen Zhonghao/Xinhua/Getty Images

Europe's best hope for an EV battery manufacturer reached the end of the road last month.

Northvolt, the EV battery maker founded by two former Tesla executives and backed by the likes of Volkswagen and Goldman Sachs, filed for bankruptcy after running out of cash.

The startup's demise after burning through $15 billion poses big questions for European policymakers — and leaves the field open for a Chinese battery titan to continue its global expansion.

CATL, the world's biggest battery producer, is already building three factories in Europe — in Germany, Hungary, and a joint venture with Jeep owner Stellantis in Spain. A spokesperson told Business Insider the company was considering expanding its manufacturing facilities further, in line with market demand.

ATTILA KISBENEDEK/AFP/Getty Images

CATL is also embarking on a hiring spree, recruiting about 1,800 employees at its German plant and planning to add more than 1,300 staff in Hungary by the end of the year.

As scrutiny over Chinese firms operating in Europe escalates in recent years, manufacturers including CATL and BYD have sought to localize production by building factories in European countries.

In CATL's case, the push to blend in reportedly included adding bratwurst and German barbecue to the menu at its German factory.

As well as building batteries, CATL is also looking at ways to recycle them.

A spokesperson told BI the company was "exploring strategic partnerships" with local firms to build a battery recycling network in Europe.

The European scale-up comes at a key moment for CATL, which has grown rapidly thanks to enormous state support and China's stranglehold over the global battery supply chain.

CATL is gearing up to go public in Hong Kong in a $5 billion offering and recently struck a deal with Chinese EV maker Nio to develop a battery-swapping network for electric vehicles in China.

The demise of Northvolt, widely seen as the continent's most promising battery startup, has left Europe's home-grown battery industry struggling to compete.

"Northvolt bit off more than it could chew," said Sam Jaffe, principal at 1019 Technologies, which advises companies on the battery industry. "They were trying to build six gigafactories in different parts of the world all at once, and they should have just concentrated on just one."

Jaffe said Northvolt's investors were expecting unrealistic "venture-like" returns from the capital-intensive business.

While Northvolt's failure won't be a "death knell" for Europe's efforts to build EV batteries, he said ownership of the continent's battery industry was likely to be dominated by Chinese and Asian companies.

That prospect has sparked some soul-searching in Europe. Julia Poliscanova, a senior director of the Transport & Environment thinktank, said the European Union had failed to turn world-class battery R&D into a successful manufacturing sector: "Northvolt is just a symptom of the problems that we have in Europe."

She said the EU should learn from the "Chinese playbook" as it looks to build a competitor to CATL, sticking with consistent EV policies and overhauling trade rules that allow Chinese battery makers to import their products at a 1.3% tariff.

Poliscanova also urged Europe to explore measures that would force Chinese manufacturers to partner with European rivals and share vital knowledge if they want to do business on the continent.

China adopted similar joint-venture rules with its auto industry in the 1990s. They proved a powerful tool in helping Chinese carmakers catch up with Western competitors.

"The Chinese didn't wake up being good at battery manufacturing — they've simply been doing it for a lot more years," said Poliscanova. "The problem is that today in Europe, we don't have all those years to learn and fail."

Shifting geopolitical tensions are likely to only make Europe a more tempting target for Chinese firms.

China's EV giants such as BYD have been locked out of the US by high tariffs, but are expanding rapidly in Europe due to less restrictive trade barriers. Jaffe said the battery industry could follow a similar playbook.

"I think we're going to see a clear demarcation between the North American battery industry, which is going to be mostly Korean partnerships with local companies, and the European battery industry, which is going to be more partnerships with Chinese manufacturers," he said.

2024 was "a year of growth," according to fire-suppression company Fire Rover, but that's not an entirely good thing.

The company, which offers fire detection and suppression systems based on thermal and optical imaging, smoke analytics, and human verification, releases annual reports on waste and recycling facility fires in the US and Canada to select industry and media. In 2024, Fire Rover, based on its fire identifications, saw 2,910 incidents, a 60 percent increase from the 1,809 in 2023, and more than double the 1,409 fires confirmed in 2022.

Publicly reported fire incidents at waste and recycling facilities also hit 398, a new high since Fire Rover began compiling its report eight years ago, when that number was closer to 275.

© Fire Rover/YouTube

Rather than trying to beat Chinese companies, Coreshell attempting an end run, swapping graphite for its specially coated silicon.

© 2024 TechCrunch. All rights reserved. For personal use only.

Jose Luis Pelaez Inc/Getty, Yevhen Borysov/Getty, Iana Kunitsa/Getty, Hinterhaus Productions/Getty, Tyler Le/BI

Four ex-employees of a lithium startup bankrolled by Bill Gates' climate investment firm have sued the company, accusing it of "recklessly" exposing them to toxic chemicals that left them sick and injured.

The former workers at Lilac Solutions say in a 60-page lawsuit they were fired after they repeatedly sounded the alarm to upper management about their "overexposure" to hazardous dust and fumes inside a poorly ventilated Oakland, California, warehouse.

Lilac hit back against the ex-employees with its own lawsuit in late January, alleging the ex-workers "intentionally misappropriated" the startup's trade secrets through their public court filings.

The company, which has said it raised more than $165 million in funding led by Gates' climate investment firm Breakthrough Energy Ventures, developed new technology to extract lithium, a crucial material in electric car batteries.

Gates is not personally affiliated with the lithium company. His investment firm is not named in the ex-workers' lawsuit.

A previous Business Insider review found companies are using trade secrets law as a legal strategy against workers who have accused them of wrongdoing.

Nick Yasman, an attorney with West Coast Trial Lawyers who represents the former employees, told BI that Lilac's countersuit is a "pressure tactic to scare" his clients into backing down, and called the suit "utterly unmeritorious.

A Lilac spokesperson, though, told BI that "the allegations against the company are completely without merit."

"Lilac Solutions will vigorously defend itself and its employees in this lawsuit, and we are confident that the legal process will vindicate us from these baseless allegations," the spokesperson said. "Our focus remains on delivering industry-leading technology that unlocks faster, cheaper and cleaner lithium production to meet growing industry demand."

The former employees' lawsuit against Lilac alleges that the company "sacrificed human health and safety in pursuit of its goals."

Plaintiffs Michael Mitchell, Khiry Crawford, Tyler Echevarria, and Anthony McCune worked out of Lilac's Oakland processing plant, assisting in the manufacturing of tiny ceramic ion exchange "beads" used in the company's process to extract lithium from brine, the lawsuit, filed in late November in California's Alameda County Superior Court, says.

The beads or ion exchange material, referenced in court papers as "IXM," "was comprised of many different toxic and hazardous chemical compounds," says the lawsuit, which highlights a specific chemical compound, only identified as "Compound A," containing "a toxic chemical" only referred to as "Chemical 1."

"While Compound A can be a benign material at small exposure levels, significant exposure to Compound A can lead to high levels of Chemical 1 in the human bloodstream," the lawsuit says. "High enough concentrations of Chemical 1 in the bloodstream can lead to Chemical 1 poisoning, which is a toxic condition caused by overexposure or chronic exposure to Chemical 1."

The plaintiffs allege Lilac stored its stock of "Compound A" in torn bags that were "carelessly" piled on the warehouse floor, allowing particles to escape into the air.

Test results eventually confirmed that the ex-employees were "actively being exposed to toxic and dangerously high levels of Chemical 1 every work day," the lawsuit says.

Prior to their employment at Lilac, the lawsuit says the plaintiffs were physically healthy. Yet when they were at the company and after they left, they experienced symptoms including severe respiratory pains, coughing, difficulty breathing, abnormal gastric pains, loss of balance, nervous system tremors, uncontrollable shaking in their hands and limbs, severe insomnia, anxiety, and depression, their lawyers allege in the complaint.

The plaintiffs say that throughout their employment with Lilac from 2021 to 2024, they were "regularly warned by colleagues about the danger of the materials they worked with," but were provided with "extremely minimal and grossly insufficient personal protective equipment."

The ex-workers say in the complaint their physical injuries were "substantially caused by LILAC's willful concealment of the identities of many toxic chemicals," as well as arsenic.

The former employees allege that their desks and workspaces were "constantly" covered in chemical dust and engulfed by fumes and that the "toxicity was inescapable."

As early as 2021 and through January 2024, the employees complained to management about the "grossly insufficient" ventilation system in the warehouse, the lawsuit says.

"Despite Plaintiffs complaints, LILAC took no measures to increase ventilation and air purity within its warehouse until January 2024, after Plaintiffs were terminated," it says.

On January 16, 2024, the workers were notified of their terminations and told it was the result of a "reduction in force," the lawsuit says.

The lawsuit argues that the plaintiffs' complaints about workplace health and safety and "whistleblower complaints" about Lilac's "noncompliance with state and local health and safety codes and regulations, substantially caused and contributed" to the company's decision to end their employment.

The lawsuit alleges California labor code violations, whistleblower retaliation, negligence, and discrimination.

"It's a whistleblower retaliation case where the people who complained the most were the same ones who were fired," Yasman told BI.

After their firings, the plaintiffs filed complaints of retaliation against Lilac with California's Labor Commissioner's Office and complaints with the state's Division of Occupational Safety and Health, resulting in OSHA issuing Lilac four citations, the lawsuit says.

Lilac filed its countersuit against the ex-employees on January 31, calling it " a case of clear and intentional misappropriation of trade secrets" in court papers.

The former workers, Lilac's lawsuit says, "gained access to Lilac's trade secret information relating to the chemicals and processes Lilac uses to manufacture certain ceramic beads."

It's a process that "none of its competitors do, know how to do" or were aware that Lilac does, the lawsuit says.

The lawsuit, which also alleges breach of contract, says the ex-employees were made aware that the chemicals and processes used to manufacture the so-called "IX beads" were "highly confidential and that they were not permitted to be disclosed to anyone outside of Lilac."

Lilac alleges that the company "has been and continues to be irreparably harmed" as a result of the ex-workers' "misappropriation of its trade secrets."

Its lawsuit says a draft of the former workers' legal complaint included repeated references to "Chemical 1," which the company describes in the court papers as "the most important chemical in the manufacturing of the IX Beads."

Yasman, during an interview with BI, argued that the trade secrets Lilac has alleged can be found on the company's own website or in publicly filed patents.

The attorney and his team have filed a special motion to strike the case under California's anti-SLAPP law that's designed to curb meritless lawsuits and protect free speech rights.

Google is replacing lead-acid battery backup units with lithium-ion cells, freeing up space for more servers.

© 2024 TechCrunch. All rights reserved. For personal use only.

Though the Swedish startup has raised over $14 billion, it has been running short on cash recently.

© 2024 TechCrunch. All rights reserved. For personal use only.

Northvolt

Northvolt, the electric vehicle battery maker founded by two former Tesla executives, has reached the end of the road after failing to secure additional funding.

The Swedish company's board announced the bankruptcy on Wednesday, saying that it had "explored all available means to secure a viable financial and operational future for the company."

Northvolt said it faced multiple challenges in recent months that undermined its financial position, including growing capital costs and geopolitical instability, resulting in supply chain disruptions and fluctuating demand.

Despite support from lenders and filing for Chapter 11 bankruptcy protection in November, the company failed to achieve the financial conditions required to continue operating.

A Swedish court-appointed trustee will now oversee the sale of the business and its assets.

"This is an incredibly difficult day for everyone at Northvolt," Northvolt's interim chair, Tom Johnstone, said in a statement.

"We set out to build something groundbreaking — to drive real change in the battery, EV, and wider European industry and accelerate the transition to a green and sustainable future."

Northvolt aimed to become Europe's main EV battery manufacturer and counter the dominance of Chinese rivals such as CATL and BYD.

It was founded in 2016 by Peter Carlsson and Paolo Cerutti and had raised more than $15 billion from investors including Volkswagen, Goldman Sachs, BlackRock, Baillie Gifford, and Spotify cofounder Daniel Ek.

Northvolt grappled with escalating debts, operational efficiencies, and a reliance on Chinese equipment that hindered its production capabilities.

The bankruptcy affects Northvolt AB and its Swedish subsidiaries.

Northvolt's German and North American businesses are not filing for bankruptcy in their respective jurisdictions, though the court-appointed trustee and company lenders will determine their future.

The collapse comes as European automakers struggle with weak demand for EVs and rising competition from Chinese rivals.

Volkswagen, Europe's largest automaker, is considering closing factories in Germany for the first time and cutting tens of thousands of jobs due to weak EW demand and excess capacity.

Last week, Mercedes-Benz announced staff buyouts and half-salary reductions to improve earnings following a decline in sales in 2024.

Ford, meanwhile, said last November it would cut 4,000 jobs in Europe by the end of 2027.

Cheaper, lighter, and denser: The trifecta defines an ideal battery. No one has devised a perfect cell quite yet, but one stealthy startup thinks it has found a new material that solves at least two of those challenges. Daqus Energy has been quietly operating for the past four months, refining a compound known as TAQ […]

© 2024 TechCrunch. All rights reserved. For personal use only.

As the owner of a 3-year-old laptop, I feel the finite lifespan of lithium batteries acutely. It's still a great machine, but the cost of a battery replacement would take me a significant way down the path of upgrading to a newer, even greater machine. If only there were some way to just plug it in overnight and come back to a rejuvenated battery.

While that sounds like science fiction, a team of Chinese researchers has identified a chemical that can deliver fresh lithium to well-used batteries, extending their life. Unfortunately, getting it to work requires that the battery has been constructed with this refresh in mind. Plus it hasn't been tested with the sort of lithium chemistry that is commonly used in consumer electronics.

The degradation of battery performance is largely a matter of its key components gradually dropping out of use within the battery. Through repeated cyclings, bits of electrodes fragment and lose contact with the conductors that collect current, while lithium can end up in electrically isolated complexes. There's no obvious way to re-mobilize these lost materials, so the battery's capacity drops. Eventually, the only way to get more capacity is to recycle the internals into a completely new battery.

© Kinga Krzeminska

Garbage truck fires are never ideal, but they are usually not catastrophic. When a fire broke out on December 6 in the back of a garbage truck making its Friday rounds through the Chicago suburb of Arlington Heights, the fire department responded within five minutes. Firefighters saw flames shooting five feet into the air out the back of the truck, and they prepared to put the fire out using hoses and water. Four minutes after their arrival on scene, however, the garbage truck exploded in rather spectacular fashion, injuring several firefighters and police officers, damaging several homes in the vicinity, and scattering debris through the neighborhood.

The truck, it turned out, was powered by compressed natural gas (CNG) stored in five carbon-fiber-wrapped cylinders on the roof. The cylinders had pressure relief valves installed that should have opened when they reached a temperature between 212° and 220° Fahrenheit (100°–140° Celsius). This would vent (flammable) methane gas into the atmosphere, often creating a powerful flamethrower but keeping the tanks from exploding under the rising pressure caused by the heat. In this case, however, all the pressure relief devices failed—and the CNG tanks exploded.

Fire officials now believe that the whole incident began when a resident improperly disposed of a lithium-ion battery by placing it in a recycling bin.

Lithium may be the key component in most modern batteries, but it doesn't make up the bulk of the material used in them. Instead, much of the material is in the electrodes, where the lithium gets stored when the battery isn't charging or discharging. So one way to make lighter and more compact lithium-ion batteries is to find electrode materials that can store more lithium. That's one of the reasons that recent generations of batteries are starting to incorporate silicon into the electrode materials.

There are materials that can store even more lithium than silicon; a notable example is sulfur. But sulfur has a tendency to react with itself, producing ions that can float off into the electrolyte. Plus, like any electrode material, it tends to expand in proportion to the amount of lithium that gets stored, which can create physical strains on the battery's structure. So while it has been easy to make lithium-sulfur batteries, their performance has tended to degrade rapidly.

But this week, researchers described a lithium-sulfur battery that still has over 80 percent of its original capacity after 25,000 charge/discharge cycles. All it took was a solid electrolyte that was more reactive than the sulfur itself.

© P_Wei

The Pixel 4a, a well-regarded release in Google's line of budget-minded phones with nice cameras and decent stock software, was not supposed to get any more updates. This week, it will receive a rather uncommon one—one that intends to lower its reported battery life.

The Pixel 4a, released in the summer of 2020, was discontinued at the end of 2022. It received its last official software update in the summer of 2023, followed by a surprise security update in November 2023. Throughout 2024, there were no updates. This week, owners of the 4a (and likely many former owners) are getting a new update, along with an email titled "Changes coming to your Pixel 4a."

The email addresses "an upcoming software update for your Pixel 4a that will affect the overall performance and stability of its battery." The automatic software update to Android 13 "introduces new battery management features to improve the stability of your device," which will "reduce your battery's runtime and charging performance."

© Ron Amadeo