Reading view

Can Trump's Tariffs Help Create a 'Golden Age' of US Manufacturing?

We Are the Oceans | Opinion

The EU Needs a Navy. Can the UK Supply It? | Opinion

Trump's FEMA risks "flying blind" into hurricane season

President Trump's campaign to dismantle FEMA is on the verge of a high-stakes stress test, as the U.S. hurtles toward peak disaster season under uniquely dangerous conditions.

Why it matters: Extreme weather is growing deadlier and more destructive. But instead of strengthening the systems that help states respond, the Trump administration is gutting FEMA, banning climate change research and urging governors to go it alone.

State of play: With less than two weeks until the start of Atlantic hurricane season, leaks from inside the government continue to suggest that FEMA is understaffed, underfunded and underprepared.

- Acting FEMA head Cameron Hamilton was fired earlier this month after testifying to Congress that eliminating the agency — as Trump has called for — is not "in the best interests of the American people."

- His successor, David Richardson, has no experience managing natural disasters and acknowledged in private meetings that the agency doesn't yet have a fully formed hurricane response plan, the Wall Street Journal reported.

- "As FEMA transforms to a smaller footprint, the intent for this hurricane season is not well understood," warned an internal review obtained by CNN. "Thus FEMA is not ready."

The big picture: Trump — whose budget proposes more than $646 million in cuts to FEMA — has signed executive orders aimed at streamlining the federal disaster agency and shifting more responsibility to the states.

- "I say you don't need FEMA. You need a good state government," Trump said during a tour of the Los Angeles wildfires in January. "FEMA is a very expensive, in my opinion, mostly failed situation."

- FEMA, which was created under President Jimmy Carter and is part of the Department of Homeland Security, has shed roughly 1,000 workers and over a dozen senior leaders as a result of DOGE cuts.

- DHS Secretary Kristi Noem told Trump in March that she would move to "eliminate" FEMA, though that would ultimately require an act of Congress.

Zoom in: Miami hurricane specialist John Morales warned that staffing cuts at FEMA are "yet another reason hurricane season 2025 has a greater chance of being the most tragic in memory."

- Morales — who was brought nearly to tears on live TV last year during his coverage of Hurricane Milton — told Axios he feels like he's "flying blind heading into this hurricane season."

- The FEMA cuts and reductions at the National Weather Service — as well as the elimination of disaster databases maintained by federal scientists — could potentially cost lives, he said.

As tornadoes have ripped across parts of the central and southern U.S. in recent days, local leaders pleaded for federal aid.

- St. Louis Mayor Cara Spencer said Monday, days after a deadly tornado outbreak in her city: "This is where FEMA and the federal government has got to come in and help our communities. Our city cannot shoulder this alone. The state of Missouri cannot shoulder this alone."

- Asked whether FEMA was on the ground yet, she said no.

- The White House and FEMA did not immediately respond to Axios' request for comment.

Flashback: Trump has a long history of spreading misinformation about natural disasters and FEMA — including during the campaign, when Hurricanes Helene and Milton impacted multiple southern states.

- He has also threatened to weaponize disaster relief against blue states, demanding, for example, that California implement voter ID in exchange for federal wildfire aid.

Between the lines: "I think we're all in agreement about [FEMA] reform, but let's do it smartly and be able at the same time to complete the mission," Pete Gaynor, who ran FEMA for about two years during Trump's first term, told Axios' Alex Fitzpatrick earlier this year,

- The frequency and extremity of disasters themselves have strained FEMA's "workforce in unprecedented ways," a U.S. Government Accountability Office report found early last year.

- The agency is on track to run out of disaster relief funds by July or August for the third consecutive year, and the administration canceled billions of dollars in grants for disaster preparedness.

- As climate change worsens the severity of storms in disaster-prone states, many of them are still reeling from one storm (Helene) when the next one hits (Milton).

But the timing of Trump's FEMA overhaul couldn't be worse, experts warn.

- "If you're serious about making a big policy change, and shifting the balance of responsibility from federal to state government, you have to give states a chance to legislate to fill the gap," Sarah Labowitz of the Carnegie Endowment for International Peace told Axios.

- "A lot of state legislatures are meeting now and winding down their legislative sessions before there's a clear policy landscape from the administration, and while disaster season is getting started," she added.

Go deeper: These states could suffer the most without FEMA

Axios' Martin Vassolo contributed to this report.

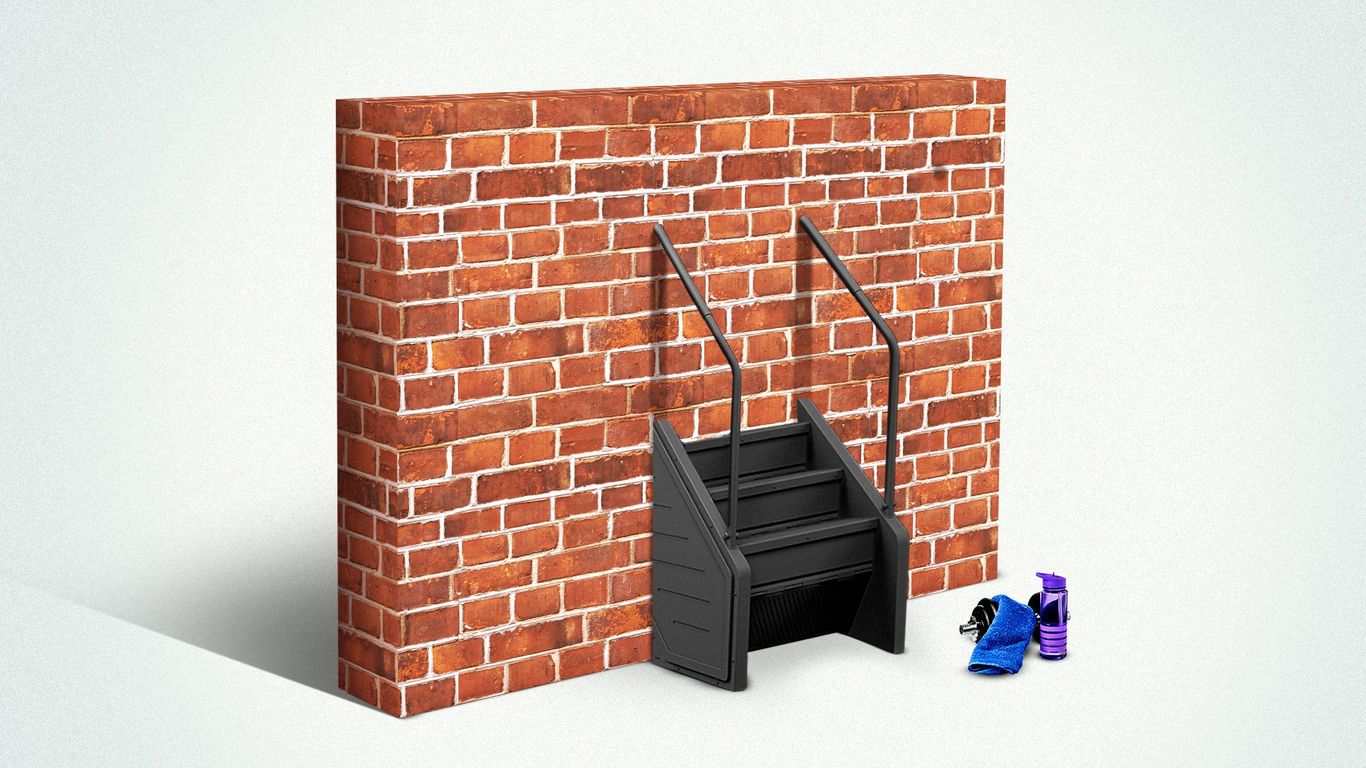

The age when your workout routine is most at risk

New research says 49 is the age when physical activity markedly declines.

Why it matters: Putting a number on when exercise drops off could encourage people to establish active habits early — before brain changes can make it harder to get moving.

"We've always said this phrase, 'Physical activity declines with age.' It's really nice to be able to put a number to it," said Timothy Morris, an assistant professor of physical therapy, human movement and rehabilitation sciences at Northeastern University.

- Morris co-authored the study, which builds on a body of longevity research showing it's hard to maintain a physically active lifestyle as we age. Some evidence points to ages 44 and 60 as times of accelerated aging.

What they did: Researchers analyzed MRI scans and self-reported activity levels from adults ages 18 to 81. 52% were female and 48% male.

What they found: Physical activity drops off suddenly around age 49.

- The study used data from nearly 600 people in and around Cambridge, U.K., so the findings may not apply broadly.

The big picture: The brain could be partly to blame for a drop in exercise, Morris said.

- When you age, the part of the brain that helps control impulses — the "salience network" — changes.

- So at a certain point, your brain won't naturally "inhibit that desire to sit on the sofa," Morris says.

How can we get motivated to move, despite a desire to stay put?

Start young.

- During childhood is best. Kids who play sports growing up are more likely to be physically active as adults, studies find.

Make it fun.

- Opting to be active simply because it feels good might help you bypass the innate human desire to minimize effort, Morris said.

- Morris is finding preliminary evidence that offering adults "points" for exercising (equivalent to a few cents) gets people out the door. And it seems to be much more effective at getting people moving than reminding them of the health benefits of exercising.

What we're watching: A postdoc in Morris' lab is focused on the connection between exercise and brain changes specific to perimenopause, a topic that's gotten more research and legal attention lately.

Boomers are leaving their millennial children with a huge headache

Getty Images; Alyssa Powell/BI

Chelsea Atkinson understood, at least in theory, that her father's house might one day be hers. She just didn't expect that day to arrive so soon.

The death of her father in 2019 came as a shock: He was just 58, but complications from an earlier bout with lung cancer led to a quick decline. "It was like, 'Boom,'" Atkinson says. She was 28, an only child, and had already purchased a house in Austin, where she'd grown up. Grief aside, the inheritance of her childhood home, with the mortgage fully paid off, might seem like a winning lottery ticket. But the property came with an endless stream of dilemmas that Atkinson was entirely unprepared to resolve.

She and her father hadn't been on speaking terms in his final years, and she had no desire to move back into a home weighted with memories. She briefly considered turning it into a rental, only to conclude that she had zero interest in becoming a landlord. That left Atkinson to sell, but the 40-year-old house was showing its age. She would have to choose between pouring thousands of dollars into upgrades or offloading the house for well below what it might be worth. There was also the conundrum of what to do with all the stuff inside: sentimental artifacts, antique furniture, and worthless clutter. She would have to pay someone to haul literal truckloads away.

"All those questions start popping up," Atkinson tells me. "Like, 'What are you going to do with this thing that you really didn't know you were going to be getting so soon?'"

Millions of millennials will soon have to wrestle with similar choices. The US is on the precipice of a colossal wealth transfer, with the oldest baby boomers set to turn 80 next year. As they find spots in nursing homes, move in with younger relatives, or die, members of the once-largest generation will leave behind a staggering heap of real estate. This Great Boomer Bequeathment will pose unique questions and challenges for their millennial offspring. Aside from the ever-present family drama and arcane tax considerations, baby boomers are staying in their homes far longer than previous generations, which means many of their homes will likely demand extensive renovations. Their inheritors, if they choose to sell, may find themselves thrust into a weaker market as housing demand slows due to sluggish population growth. It also remains to be seen how much of those real estate riches will actually make it to millennials' bank accounts after years of retirement spending and eldercare.

That's not to say that these inheritances will be all burden and no bounty. Far from it. Handing down real estate can extend a financial lifeline to the next generation, offering an immediate windfall, a potentially lucrative investment, or a homeownership cheat code. But to pull off that smooth transfer, boomers will need to have some frank conversations about their futures.

"I think most people just don't like to think about dying," says Scott Westfall, a 33-year-old real estate broker in Virginia Beach, a popular landing spot for the retirement crowd. "You've got to face that you will die someday, or your parents will die someday, and so it's better to have a conversation now than be surprised by it."

Baby boomers dominate America's housing market. They own roughly $19.7 trillion worth of US real estate, or 41% of the country's total value, despite accounting for only a fifth of the population. Millennials, by comparison, make up a slightly larger share of the population but own just $9.8 trillion of real estate, or 20%. The disparity is a product of both their relative youth and the stark advantages enjoyed by their elders. Flush with cash from prior home sales and burgeoning stock portfolios, boomers can afford to win bidding wars and upgrade, downsize, or collect rental properties like Monopoly pieces. Even last year, with millennials solidly in their peak homebuying years, baby boomers gobbled up the lion's share of the market. They accounted for 42% of buyers between July 2023 and June 2024, data from the National Association of Realtors found, well outpacing millennials' measly 29% share.

Boomers are a big reason Americans are stuck in place: People are staying in their homes almost twice as long as they used to, a Redfin analysis found, with nearly 40% of boomers having lived in their homes for at least 20 years and another 16% staying put for 10 to 19 years. A survey of 1,000 boomers by Leaf Home and Morning Consult found that 68% lived in homes that were at least three decades old, "with many never having done renovations or replacing major appliances, and most having no plans to move or make any type of home improvements." Their motivations for staying put range from lifestyle preferences to financial savvy. A number of surveys indicate that many boomers want to age in place rather than retreat to a nursing home or move in with family. They're also more likely to own their homes free and clear, with no pesky mortgage payments each month. Even if they do pull up stakes, they might hold onto their old place as a rental property rather than sell.

Soon, though, Father Time will force the generation to either pass along those homes to lucky inheritors or dump them on the market. While demographers emphasize that this will be more of a glacial shift rather than the well-publicized, instantaneous "silver tsunami," this changing of the guard will happen. Between 2025 and 2035, boomers' numbers are projected to decline by 23%, or about 15.6 million people, according to an analysis of Census data by the Harvard Joint Center for Housing Studies. Between 2035 and 2045, their numbers are expected to drop by another 47%, or 23.4 million people.

I think the biggest problem is in the year or 10 years before inheritance.Ari Rubin, founder and CEO of Flock Homes

While a horizon of a decade or two may seem a long way off, financial planners and real estate agents warn against kicking the can down the road. By the time millennials actually inherit a house from their parents, Westfall tells me, it'll be "too late" to figure out the best way to set up that transfer. In many instances, questions around the fate of a house will crop up long before its owner dies. An aging baby boomer may be forced out of their home and into a nursing home, leaving their progeny to figure out how to balance paying for upkeep on the house, a mortgage if there is one, property taxes, and the necessary healthcare. Without money set aside for these things, along with clear instructions for what to do with the house in those final years and beyond, the situation can easily devolve into chaos. Unprepared millennials may end up with their hands tied. Ari Rubin, the founder and CEO of Flock Homes, a company that bills itself as a "retirement solution" for landlords and regular homeowners, warns that they could wind up inheriting responsibility for the home years before they actually assume the title.

"I think the biggest problem is in the year or 10 years before inheritance," Rubin says.

Millennial inheritors are often eager to climb the housing ladder, but they may not be prepared for all the monthly costs that go into paying off and maintaining a home that's a few rungs above their current costs. That's not to mention the big-ticket upgrades or repairs that are often required after someone has lived in a home for several decades. And even if your boomer parents move into a nursing home or the granny flat in your backyard, there may be good reasons, tax-wise, for waiting to sell or transfer the old home until they die, especially if the house's value has appreciated a lot (more on that later).

Flock Homes offers one answer to this common predicament. The company, which recently raised a $20 million Series B, gives aging homeowners (or their inheritors) the chance to exchange their burdensome homes for a stake in a diversified real estate fund — while deferring taxes — through a little-known maneuver known as a 721 exchange. That's far from the only option, though. There's a whole cottage industry devoted to greasing the handoff of homes from one generation to the next, offering products designed to minimize Uncle Sam's ability to put his hand in your coffers.

There's no "correct" way to pass down a home. For some families, a simple beneficiary deed, which transfers the title upon death, will do the trick. Others will need to make more complex arrangements. Setting up the house in a trust — a set of legal documents that define exactly who gets it and when, what they can (and can't) do with it, and maybe even set aside money to fund its upkeep — can provide a road map for inheritors and nip intrafamilial squabbling in the bud.

"It helps provide a structure with specific direction on how those assets are treated after they're gone," says Jeremy Taylor, who manages real estate advisory services at Commerce Trust.

On the other hand, overly restrictive trusts could leave millennial inheritors in a bind. Taylor cites examples in which the parents dictated that their house be held in the family for a set number of years, but underestimated the amount of money they'd need to leave behind in order to keep up the place during that time. "There's a trust with no cash and property to be maintained," Taylor tells me, "and not a lot of flexibility for the trustee to sell." The inheritors may end up stumbling through the court system for months to get permission to offload the property. And, of course, trusts can't completely solve the family tension that often arises when valuable assets need to be divvied up.

Then there's the tax question. One of the preoccupations among the investment management crowd is helping clients dodge what's known as the capital gains tax, which applies to the profits made from selling assets, like homes or stocks, that have grown more valuable over time. If your boomer parents sell a house while they're alive, they'll have to pay taxes — as much as nearly 40% — on the amount the home has appreciated since they bought it. Sure, the first $250,000 to $500,000 of those gains are tax-exempt, depending on your filing status, but given that many boomers have held onto their homes for decades, their profits may well exceed those thresholds. The IRS offers a nifty hack, though, called the "stepped-up cost basis," that allows inheritors to sell the property with a minimal tax bill. When a homeowner dies and passes along their property, the starting point used in those capital gains calculations gets bumped up to the house's current value, instead of the value at which it was purchased.

Let's take a theoretical example: Say your father bought a home back in 2010 for $400,000. He's a smart guy, picked a good neighborhood in an up-and-coming city, and did a little touching up of the home, so 15 years later the house is worth $1.1 million, which comes out to a hefty $700,000 gain. If he sold it before dying, he'd have to pay taxes on $450,000 of those gains after subtracting the aforementioned exemptions. But if he hands it down to you in his will, the starting point value of the house gets adjusted to $1.1 million — in other words, if you sell for that price, or even a little more, the government doesn't consider you to have "gained" any value since the inheritance, so your tax bill is nothing.

So many parents want their kids to have the house, and so many kids want to inherit the parents' house — until they hear about the property tax.

Joe Metz, a Bay Area real estate agent and the founder of Senior Homeowner Solutions, has built an entire second career out of helping people pull maneuvers to avoid the capital gains tax. But for people who decide to keep their deceased parents' home, he says, there's another bill that people often don't consider: property taxes. People just don't think about the ongoing costs of homeownership as much as they should. Data from the real estate analytics firm Cotality found that the median annual property tax bill has jumped 42% since 2019, to more than $3,000. The tax hits can be especially jarring in Metz's home base of California, where they typically spike once a house is passed down. In San Francisco, for instance, property taxes on a $3 million home could stretch past $30,000 a year. And again, that doesn't include insurance, a mortgage, and the random repairs that often crop up.

"So many parents want their kids to have the house, and so many kids want to inherit the parents' house — until they hear about the property tax," Metz tells me.

Laura de Vera, a 35-year-old chef in Washington, DC, found that handling an inheritance can be tough even when all the specifics have already been accounted for. When her mother died from cancer in 2020, she left behind a trust with stipulations that detailed how long de Vera's stepfather could live in her old house and how the proceeds from a sale would be divided among him, de Vera, and her sister. She also accounted for every belonging, down to the jewelry inside the place. "She was very candid and just very practical," de Vera says of her mother. De Vera's stepfather opted to sell the home quickly for a handsome gain, which was fortunate — de Vera says she was lost in a fog of grief for months, and had to devote time to all the other logistics that come with death. Years later, she's still grateful for the steps her mother took ahead of time.

"We were as prepared as you possibly can be in that situation," de Vera tells me. "There's nothing my mom could have done better, and it was still just devastatingly difficult to slog through, because of how emotional the situation is."

For some millennials, stressing over what to do with their parents' assets may turn out to be a moot point. My colleagues at BI have thoroughly reported on all the outlays that eat into inheritances: living expenses during retirement, senior care for aging parents, home repairs, and the hundreds of other day-to-day costs that put a dent in our wallets. Given the rising expenses of growing old and the locations that boomers have chosen to spend their golden years, Daryl Fairweather, the chief economist at Redfin, says she's skeptical of the idea that all this wealth will trickle down to the next generation.

"I think some of it is going to kind of evaporate, because the homes are not the kind of homes that younger people want," Fairweather tells me. "Maybe the insurance costs are too high because they're in climate-risky areas, or they had to take out reverse mortgages to pay for all their eldercare" — which, in the most extreme cases, could mean little or no equity left in boomers' homes.

That won't be the case for all those millions of homes scattered around the country, though. Westfall, the broker in Virginia Beach, says homeowners in his area are keen to learn how they can protect their wealth for the next generation — so much so that he's begun hosting informational sessions in which he and a lawyer field questions from the silver-haired set. As for the young'uns, Westfall tells me the best way for millennials to prepare for the future is to simply have a conversation with their parents. You don't have to frame it as "I expect something," Westfall says, but it's the cleanest way to make sure that what should be a blessing doesn't turn into a nightmare.

The homes are not the kind of homes that younger people want.

Atkinson, the homeowner in Austin who inherited her father's house, eventually decided to sell to a neighbor who had helped care for her father late in his life. The price totaled $200,000 — well below the going rate in the area, Atkinson admits. But she was happy to leave the house in the hands of someone who felt like family, rather than a developer intent on tearing it down and erecting a McMansion. By the time she sold, in 2020, she'd spent about a year combing through the clutter and assessing her next move. She says she was glad to have the time to contemplate her decision instead of making a harried choice in the weeks after her father's death. She's even more grateful for the conversations she's had with her mother in the aftermath.

Atkinson's mother lives in a small Texas town, in a house she owns. Ever since her ex-husband died, she's been "very open about talking about death, which I think is really nice coming from a parent," Atkinson says. Her mother has gone through her possessions in detail, explaining the sentimental value of certain objects, the worthlessness of others, and her hopes for what will become of them after she dies. And, of course, she has a will.

"My dad had never really talked about dying and what happens after the fact," Atkinson tells me. "I think having that open communication with my parent will at least make the burden of what happens afterward easier."

James Rodriguez is a senior reporter on Business Insider's Discourse team.

Not quite the American dream: Renting is becoming a better deal, even if you're wealthy or a retiree

Brandon Bell/Getty Images

- Gen Z and millennials are delaying homebuying, and more older adults are renting.

- High home prices and maintenance costs are making renting more appealing than buying for many.

- Wealthy people are also choosing the flexibility and amenities that come with renting.

Gen Zers and millennials are postponing buying their first home, a growing number of older people are renting, and tenants are staying in their rentals for longer. This adds up to a record-high number of renters and an increasing share of those renters in older generations.

"Renting today isn't just for young adults starting out," said Nadia Evangelou, a senior economist for the National Association of Realtors. "It's actually a much more mixed picture. Over the past decade, we have seen more older millennials and Gen Xers staying in rentals longer, and even some boomers, for example, opting to rent later in life."

The overall number of renters has grown over the last several years. There were 45.6 million renter-occupied housing units in the US in 2023, up from 39.7 million in 2010, based on the Census Bureau's American Community Survey.

Are you renting a home longer than you thought you would, or have you become a renter again later in life? Share your experience with these reporters at [email protected] and [email protected].

The US is also seeing an uptick in older tenants. An Urban Institute projection found that the share of people 65 and older who rent their homes will grow from 22% in 2020 to 27% in 2040 — an additional 5.5 million renting households. Older Black renters will see the biggest jump, doubling in number between 2020 and 2040.

A smaller share of US renter-occupied housing units were headed by people under 35 years old in 2023 than in 2010. Meanwhile, the share of rental households headed by someone 65 or older grew over that period.

Renters are staying in their homes longer as well, per a Redfin analysis of Census Bureau data.

"Renting is becoming less of a short-term stop and more of a long-term reality for many households," Evangelou said.

Renting could be a smart financial move

The main reason people are renting for longer: the surging cost of homeownership. Home prices have soared across the country amid a housing shortage. At the same time, property taxes, home insurance, and home repair and maintenance costs are on the rise.

All of that has made renting a better deal than buying in many places — a reversal of the historic norm. Indeed, homebuyers purchasing starter homes in 50 major cities in 2024 spent over $1,000 more on housing costs each month than tenants do.

To be sure, many renters are struggling, too. Tenants' incomes aren't keeping up with rising housing costs, and a rising share of renters are cost-burdened, meaning they spend more than 30% of their income on housing.

Some Americans are renting for longer by choice. Rich renters are on the rise. Many millionaire millennials and boomers with healthy savings, who could afford to buy a home, are opting instead to rent. They like the flexibility of a lease, the convenience of having a landlord handle home maintenance, and the amenities luxury rentals offer, like in-building doggy day care, dry cleaning, and yoga classes.

"I think of renting as paying for a service, and liken it to a hotel," start-up founder Tori Dunlap, a 30-year-old multimillionaire, told BI last year. "Renting is flexible, and I don't have to worry about things that homeowners worry about, like committing to a particular place or neighborhood or dealing with a burst pipe."

Some of these affluent renters opt instead to keep their money in the market or other more flexible, higher-return investments.

"People are reevaluating whether or not they want their homes to be their asset wealth-builder," Doug Ressler, an analyst at Yardi Matrix, part of the property-management software firm Yardi, said. He added that higher-income tenants "want to have the freedom and mobility of time, and they don't want to be saddled with the things that a house brings with it."

Some financial advisors are also challenging the conventional wisdom that buying a home is a smarter financial decision than renting.

"You've been lied to about buying property," Ramit Sethi, a popular financial advisor and star of the Netflix show "How to get rich," said in a 2023 video titled "Why I Don't Own a House as a Multi-Millionaire."

Sethi recommends that those who buy a home take into account the "phantom" costs of maintenance, repairs, insurance, and buying and selling fees, and urges them to maintain diverse investments.

I started waking up at 5 a.m. to apply for jobs. It helped me land a tech role after a yearlong search.

Preeti Ladwa

- When Preeti Ladwa was job-hunting, she woke up at 5 a.m. to apply for roles.

- She also focused on roles that had been posted within the last 24 hours.

- She believes those strategies helped her land interviews and a job offer.

This as-told-to essay is based on a conversation with Preeti Ladwa, a 30-year-old platform manager who lives in New Jersey. The following has been edited for length and clarity.

I graduated with a master's in information systems in May 2023, and spent the rest of the year applying to dozens of jobs. After about 30 interviews, I still hadn't received an offer.

In January 2024, I decided to try something different: I began waking up at 5 a.m. every weekday, and after getting some coffee and taking my dog for a walk, I applied to jobs from about 6 a.m. to 10 or 11 a.m., focusing on roles that had been posted in the last 24 hours. I spent the rest of my days networking, attending events, and researching companies to see how my skills might align with their work.

This strategy worked wonders for me. From January to May, after I became more selective in my job search, I submitted seven applications and landed three interviews. On one occasion, I applied for a job at around 7 a.m. and got an interview request two hours later. The role I ultimately landed — a technical projects manager position at the American Association for Cancer Research — was one I applied for during my usual morning window. I believe my strategy didn't just improve my visibility — it helped me get hired.

I accepted the offer in May, and about four months later, I was promoted to platform manager, with my salary increasing into the six-figure range.

Applying early helped me get noticed by recruiters

My job search strategy was partly an experiment, but it was also shaped by conversations I had with recruiters.

I learned that timing can play a big role in whether your application gets seen. When a job posting attracts a lot of applicants, hiring teams may review the first batch of submissions and pause to evaluate those before looking at newer ones. If they find strong candidates early, they might not go back. That's why I decided to start applying to jobs soon after they were posted.

But I decided to take it a step further. I figured that if recruiters start reviewing applications around 8 or 9 a.m. when they log on for the day, then applying early in the morning could help me land at the top of the applicant list — right where they might be looking first. I didn't want my résumé to get buried under hundreds of others, so I started waking up early to apply to the newest job postings.

I focused on roles that had been posted within the past 24 hours, whether they went up that morning or the night before, but always applied during my 6 to 11 a.m. window. The only exception was if I had a strong referral, in which case I'd sometimes apply even if the posting was older.

Visa needs shaped the employers I chased

I first started exploring job opportunities in January 2023 while I was finishing up my master's degree at Pace University. However, most companies I interviewed with said they needed someone who could start immediately.

This was a problem for me because I had moved to the US from India in 2021, and like many international students, couldn't begin working full time until I received my employment authorization. Once I received my authorization in July, I began applying more seriously.

As my search continued, I realized I needed to be highly strategic. The large tech companies and startups I applied to were subject to the H-1B visa lottery, and many had limited sponsorship opportunities for candidates who required a visa. However, I learned that some nonprofit organizations — including some universities and research institutions — are H-1B cap exempt, which means they can sponsor international applicants at any time of year without going through the lottery.

That was a game changer. I had overlooked nonprofits at first, but I soon realized they had real IT needs and could have far less competition than other tech roles. I noticed some nonprofit job postings had fewer than 30 applicants on LinkedIn — compared to hundreds for similar roles in the private sector — which made me feel like I had a better shot. So I decided to focus on nonprofit opportunities.

Cover letters could be more helpful than referrals

In addition to waking up early to apply, I only applied for roles where I met at least 80% of the qualifications listed in the posting. I used the same résumé for every application, which was about a page and a half long.

While I pursued employee referrals early in my search, they didn't lead to interviews unless my experience was a strong match. What I think made a bigger difference was submitting a cover letter. I was also volunteering at a nonprofit during my search, and I made sure to leverage that experience in my applications. It helped me show that I understood the space and was already contributing in a meaningful way.

I didn't have any income during my job search. I had saved money from my on-campus job, and my fiancé — who had started working — supported me and our dog. I'm so grateful for that support.

After months of experimenting, refining my approach, and waking up early, I finally found a strategy that worked.

The offers flooded in for red-hot legal tech startup Legora's new $80 million funding round

Legora

- Legora cleans up $80 million in new funding round led by General Catalyst and Iconiq.

- The legal-tech platform, valued at $675 million, aids lawyers with legal research and drafting.

- Legora's funding highlights a trend in legal-tech investments, challenging rivals like Harvey.

General Catalyst and Iconiq Growth are co-leading an $80 million funding round into Legora, a startup that makes software to help bogged-down lawyers speed up legal research and drafting.

The new funding for the New York, London, and Stockholm-based Legora will value the company at $675 million, following last year's $35 million Series A. Existing investors Redpoint Ventures, Benchmark, and Y Combinator increased their stakes in this Series B round.

In an exclusive interview with Business Insider, Legora CEO Max Junestrand said the company wasn't actively seeking funding, but still, the offers flooded in. "I don't think it's a secret that things have been really working," Junestrand said.

When Seth Pierrepont heard whispers of Legora's fundraise, he boarded a flight to Stockholm. The Iconiq investor had done dozens of calls with law firms about the tools changing the way their attorneys work. The Legora name kept coming up.

"What they're looking for now is a partner," Pierrepont said, "someone that they know will build the features they ask for and will respond quickly to the questions they have. And I think that is the gap that Legora has stepped into."

Junestrand declined to provide revenue or growth figures, but said the company's revenue growth is "extremely positive." It has 250 clients in 20 markets, including big-league law firms like Cleary Gottlieb, Goodwin, Bird & Bird, and Mannheimer Swartling, Sweden's largest law firm.

Legora builds chatbots and agents — software that can perform basic tasks on their own — for things like redlining a contract, drafting, or filling in a checklist for a transaction. In recent months, it's added a Microsoft Word add-in and other features that large law firms demand.

Legora's closest analog is legal-tech heavyweight Harvey. The company works closely with major law firms to craft custom software, offering the agility of a startup with the tailored approach of a high-end consulting firm. Its annual recurring revenue surpassed $70 million in April, according to a spokesperson.

Legora's funding is the latest in a string of high-profile legal-tech investments, following companies like Harvey and Supio. General Catalyst, in particular, has been building a strong portfolio of startups reshaping the delivery of legal services. In February, it led a $105 million initial round for Eudia, a platform designed for Fortune 500 legal teams.

Mary O'Carroll, Goodwin's chief operating officer, said the firm piloted many tools before signing up with Legora. On the surface, some of the products seem quite similar, she said. But Legora edged out its competition with a clean, easy-to-use interface and a feature called tabular review, which lets users search thousands of files for exactly the information they need all at once.

Legora

Legora also stood out for its approach to empowering lawyers. The company meets regularly with firm leaders to tightly tailor the product to their needs.

"We feel like we're not just adopting the technology," O'Carroll told BI, "we're co-creating with them."

The new funding gives Legora fresh firepower to grow its team and chip away at Harvey's dominance. In addition, the company announced that General Catalyst's Jeannette zu Fürstenberg and Iconiq's Pierrepont have joined its board.

Investors are betting on the team just as much as the tech to drive growth. Jack Altman, an investor through his venture firm Alt Capital, described Junestrand as an "ambitious, gritty" European founder with a Silicon Valley ethos. Gradient's Darian Shirazi, who wrote an angel check into Legora, praised Junestrand's customer obsession, which he says is matched only by his focus on results.

With a team of around 100 employees, Legora is proving that smaller doesn't mean slower, and that being second to market doesn't mean it's out of the race.

Have a tip? Contact the reporter via email at [email protected] or Signal at @MeliaRussell.01. Use a personal email address and a nonwork device; here's our guide to sharing information securely.

These homebuyers aren't waiting for sky-high mortgage rates and home prices to come down before jumping in

gorodenkoff/Getty Images

- Mortgage rates and home prices have been prohibitively high for prospective buyers recently.

- It's unlikely that rates will come down in the near future, experts say.

- Here's why some homebuyers are sick of waiting and jumping into the market anyway.

Homebuyers in today's market are facing a tough question: buy a house now, or wait until mortgage rates and prices maybe come down?

If you buy now, you can start putting money into owning what, for most people, is their biggest asset, but you could be stuck paying a high monthly mortgage rate. On the other hand, staying on the sidelines means you could get a potentially lower rate later on at the risk of missing out on home price appreciation.

To make matters even more complicated, the threat of a recession is making it harder to make a financial decision as drastic as buying a house.

However, some homebuyers are sick of waiting for rates to come down or for the economic picture to clear up. Here's why they're ready to jump in headfirst.

Building up wealth

Aspiring homebuyers have watched prices skyrocket in recent years, and many aren't keen on missing out on future gains. These homebuyers are of the mindset that the most important thing is to simply buy in early and build up home equity, similar to the stock market mantra of "time in the market is better than timing the market."

To Bria Scott-Fleming, buying a house was one of her top priorities.

"I've been renting since I was 23, and I'm 32 now. I thought about how much money I've given away to landlords or apartment complexes. It's so much money that I spent without building any type of equity," Scott-Fleming told BI.

Scott-Fleming, a real-estate agent in the DC metro area, closed on a house earlier this month. She's also seeing similar sentiment from her clients, especially with rent prices climbing.

"People are still buying, people are still contacting me and saying they're interested," Scott-Fleming said. "Some people are intimidated by process, but the rents in DC are high, too."

Mortgage rates aren't coming down

Many homeowners aren't holding on to the hope of lower mortgage rates, especially not the sub-3% levels during the pandemic. It's unlikely the Federal Reserve will cut rates anytime soon, and mortgage rates are actually creeping up in response to Moody's downgrade of the US credit rating last week. On Monday, the average 30-year fixed rate crossed above 7% for the first time since early April.

"People have been saying mortgage rates are going to drop for the last three years, but they haven't yet," Oscar Martinez, who works at a plastic refinery in Texas, told BI. "I don't think they're going to drop anytime soon."

After living at home and saving up enough money, the 23-year-old Martinez recently took the plunge and bought a house in Texas last month, securing a 6.5% interest rate. From his perspective, it would be nice if interest rates came down — in which case he would refinance — but Martinez isn't counting on that happening. He's happy with his decision to buy and has plans to renovate the house to increase its property value.

"My opinion is that if you have the money, do it now," Martinez said of buying a house.

Lemount Griffin, a 36-year-old logistics manager, is in the market for a house in the greater Seattle area. He's not waiting for rates to drop before buying, either.

"I'm looking to buy pretty much whenever I can," Griffin said. "I'm not going to hold out for a certain rate and wait on the Fed to cut because they're probably not going to do it until September or something."

Griffin's strategy is to buy mortgage points — meaning that he pays an upfront fee to the lender in exchange for a lower interest rate on the loan. And similar to Martinez, Griffin will also take advantage of an opportunity to refinance down the road, should one arise.

Lower rates aren't necessarily a good thing

Economic uncertainty can turn away potential buyers, but for Griffin, it's actually another reason to buy a house sooner rather than later.

"I do want to buy as soon as possible because I think it's possible that Trump is going to replace Powell with somebody crazy, and his replacement will drive up inflation and housing prices," Griffin said, referring to Powell's term as Fed chair ending in May 2026.

According to Chen Zhao, Redfin's economics research lead, if the president successfully pushes the Fed to cut rates, higher inflation and mortgage rates are likely outcomes. If bond investors perceive a threat to the Fed's independence, they'll anticipate a higher risk of inflation in the future and sell off bonds, sending long-end rates higher.

For that reason, Griffin thinks the housing market could get even more expensive, which is why he wants to buy now. "I feel like it should be done before 2026," Griffin said of buying a house.

Fed independence aside, there's also a concern that lower rates will disrupt supply and demand dynamics in a housing market with low inventory. Martinez is concerned that lower rates will send demand spiking as eager homebuyers snatch up homes, bidding up prices.

"If the interest rates drop, then I feel like the price of houses will go up," he said.

China Issues No-Go Zone in Disputed Waters Claimed by US Ally

Mom Shares Footage of Daughter on 10th Birthday, but She's Already Gone

Israel Preparing Strike on Iran Amid US Tensions: Report

No Tax on Tips: When Does it Start and Who Benefits?

Elon Musk says he will still be dropping in on the White House 'for a couple days every few weeks'

Brendan Smialowski/AFP via Getty Images

- Elon Musk told investors he plans to spend more time on Tesla than DOGE.

- But Musk is not saying goodbye to Washington just yet.

- Musk said he will be at the White House "every few weeks."

Elon Musk is scaling back his involvement with the White House DOGE office, but he's not saying goodbye to Washington yet.

Musk was speaking to CNBC's David Faber in an interview on Tuesday when he was asked if he would miss being in the White House.

"My rough plan on the White House is to be there for a couple days every few weeks. And to be helpful where I can be helpful," Musk told Faber.

Musk told investors in an earnings call for Tesla last month that "the major work of establishing the Department of Government Efficiency" was done, and he would focus more on the car company.

Investors have repeatedly asked Musk to spend more time on Tesla instead of DOGE, after Musk's work at the cost-cutting outfit sparked protests and boycotts against the company.

Tesla has seen declining sales in European markets while facing increased competition from Chinese automakers like BYD. Tesla's stock is down nearly 15% this year.

Last month, President Donald Trump said he expects Musk to leave his administration "in a few months." Trump later told reporters in a Cabinet meeting at the White House that he doesn't really need Musk in his administration.

"Elon has done a fantastic job. Look, he's sitting here, and I don't care. I don't need Elon for anything other than I happen to like him," Trump said on April 10.

In a separate interview with Bloomberg on Tuesday, Musk said he will reduce his political spending. In last year's elections, Musk spent at least $277 million supporting Trump and other GOP candidates.

"In terms of political spending, I'm going to do a lot less in the future," Musk told Bloomberg. "I think I've done enough."

Representatives for Musk at Tesla did not respond to a request for comment from Business Insider.