Conservative rips blue state Republican's proposal to raise taxes on wealthy in SALT debate

EXCLUSIVE: A conservative Republican said he's opposed to his moderate colleague's proposal for a modest tax hike on high-income earners, as GOP lawmakers continue to navigate divisions over President Donald Trump's "one big, beautiful bill."

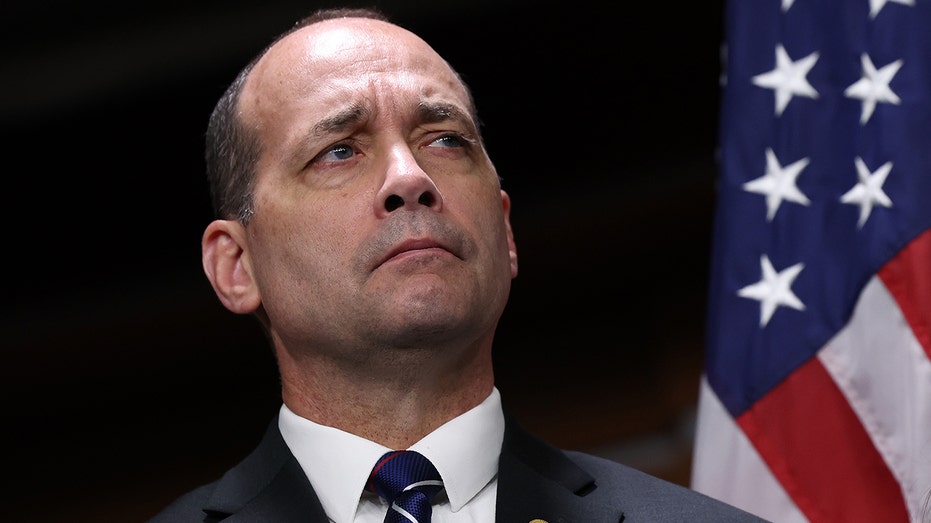

"Well, think about that — higher taxes to pay for something that is pretty much self-inflicted by all the states that don't have their financials in order," Rep. Ralph Norman, R-S.C., a member of the conservative House Freedom Caucus, told Fox News Digital on Sunday.

It comes as various House Republican factions are locked in high-stakes debates on taxes, Medicaid, and green energy subsidies while crafting Trump's wide-ranging bill.

Rep. Nick LaLota, R-N.Y., suggested over the weekend that increasing the top tax bracket to a 39.6% income tax rate rather than 37% could help pay for higher deduction caps for state and local taxes (SALT).

TRUMP'S 'BIG, BEAUTIFUL BILL' PASSES KEY HOUSE HURDLE AFTER GOP REBEL MUTINY

The 39.6% rate refers to the top income tax bracket before it was lowered by Trump’s 2017 Tax Cuts and Jobs Act (TCJA).

SALT deduction caps primarily benefit people living in high-cost-of-living areas like New York City, Los Angeles, and their surrounding suburbs.

Republicans representing those areas, including LaLota, have argued that raising the SALT deduction cap is an existential issue — and that a failure to address it could cost the GOP the House majority in the 2026 midterms.

Several of the Republicans vying for higher SALT deduction caps have pointed out that their victories are critical to the party retaining control of the House in 2024.

SALT deduction caps did not exist before TCJA, which notably instilled a $10,000 ceiling for married and single tax filers.

"The One Big Beautiful Bill has stalled—and it needs wind in its sails. Allowing the top tax rate to expire—returning from 37% to 39.6% for individuals earning over $609,350 and married couples earning over $731,200—breathes $300 billion of new life into the effort," LaLota wrote on X.

"It’s a fiscally responsible move that reflects the priorities of the new Republican Party: protect working families, address the deficit, fix the unfair SALT cap, and safeguard programs like Medicaid and SNAP—without raising taxes on the middle class."

But Republicans in lower-tax states are largely wary of significant increases to those caps, believing them to incentivize blue states' high-tax policies.

"People with money invest, and to tax them more — history has been, when you tax the other upper 1% more, you know, the economy does worse," Norman argued. "More taxes don't make sense to me."

The current legislation would increase the SALT deduction cap from $10,000 to $30,000, but a majority of Republicans in the House SALT Caucus rejected the deal.

LaLota and others have contended it's not enough for middle-class families in their districts.

"My party’s $30K cap proposal only makes 4 in 5 households whole. That’s not enough. On [Long Island], $250K isn’t rich—it barely covers the basics. Too many families pay over $15K in property taxes & get left out. I’m fighting for a higher cap. Wish me luck," he said on X.

But while tax hike proposals targeting wealthy Americans were part of Republicans' negotiations at an earlier point, any such effort appears to have been all but definitively stamped out.

House GOP leadership aides signaled to reporters on Monday morning that such a tax hike would not be in the final bill, pointing to Speaker Mike Johnson's comments on the matter.

Johnson, R-La., said on The Will Cain Show late last month that he was "not in favor of raising the tax rates, because our party is the group that stands against that, traditionally."

HOUSE GOP TARGETS ANOTHER DEM OFFICIAL ACCUSED OF BLOCKING ICE AMID DELANEY HALL FALLOUT

But nevertheless, the differing viewpoints underscore the divisions that Republicans still have to navigate ahead of their planned House-wide vote on Trump's bill later this week.

Republicans are using the budget reconciliation process to advance Trump's priorities on taxes, immigration, energy, defense and the national debt via one massive bill.

Budget reconciliation lowers the Senate’s threshold for passage from 60 votes to 51, thereby allowing the party in power to skirt the minority — in this case, Democrats — to pass sweeping pieces of legislation, provided they deal with the federal budget, taxation or the national debt.

Republican leaders want to have a final bill on the president’s desk by Fourth of July.

Fox News Digital reached out to LaLota's office for comment on Norman's remarks but did not immediately hear back.