IRS Makes Direct File Software Open Source After Trump Tried to Kill It

The tax man won't be happy about this.

The IRS open sourced much of its incredibly popular Direct File software as the future of the free tax filing program is at risk of being killed by Intuit’s lobbyists and Donald Trump’s megabill. Meanwhile, several top developers who worked on the software have left the government and joined a project to explore the “future of tax filing” in the private sector.

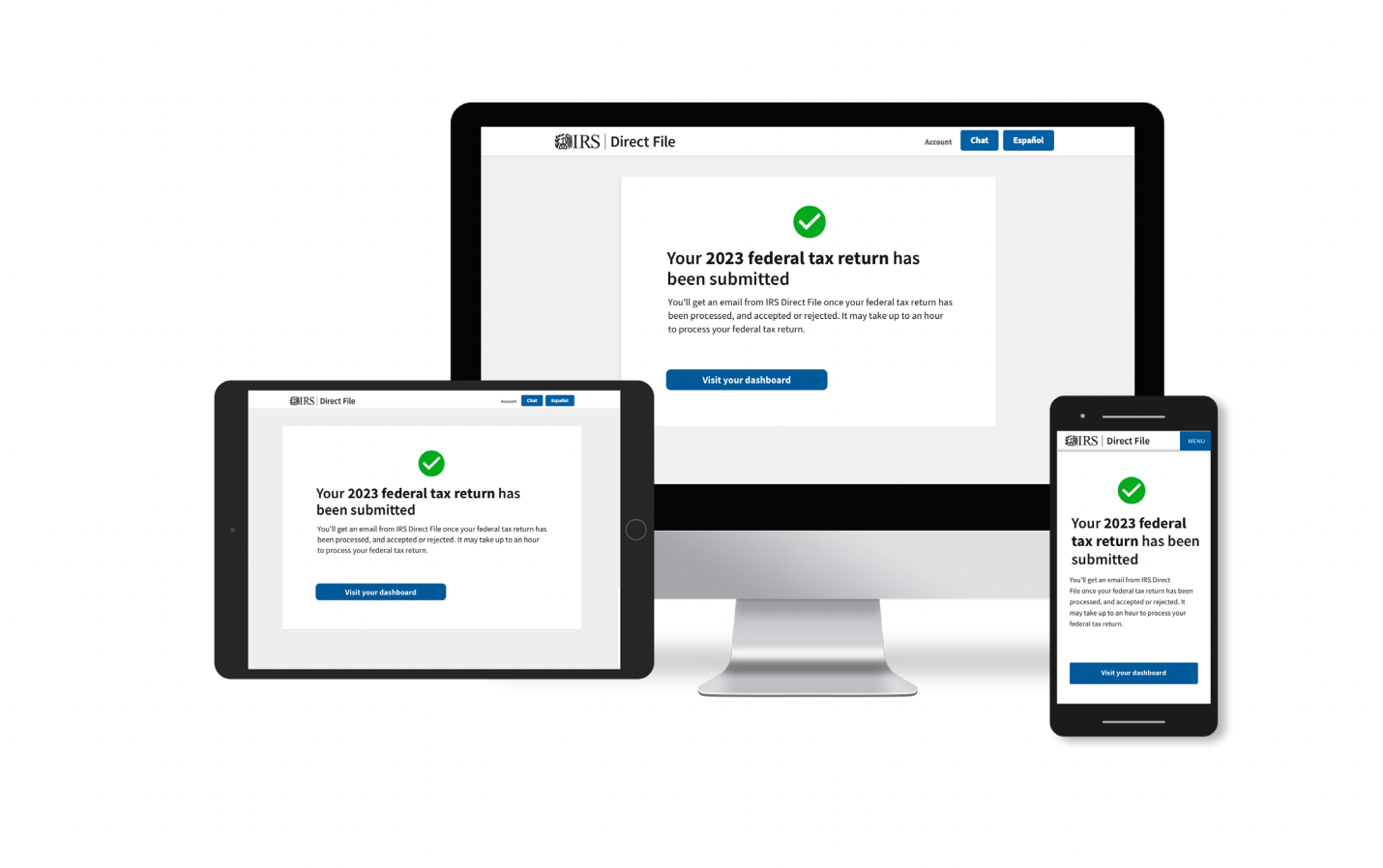

Direct File is a piece of software created by developers at the US Digital Service and 18F, the former of which became DOGE and is now unrecognizable, and the latter of which was killed by DOGE. Direct File has been called a “free, easy, and trustworthy” piece of software that made tax filing “more efficient.” About 300,000 people used it last year as part of a limited pilot program, and those who did gave it incredibly positive reviews, according to reporting by Federal News Network.

But because it is free and because it is an example of government working, Direct File and the IRS’s Free File program more broadly have been the subject of years of lobbying efforts by financial technology giants like Intuit, which makes TurboTax. DOGE sought to kill Direct File, and currently, there is language in Trump’s massive budget reconciliation bill that would kill Direct File. Experts say that “ending [the] Direct File program is a gift to the tax-prep industry that will cost taxpayers time and money.”

That means it’s quite big news that the IRS released most of the code that runs Direct File on Github last week. And, separately, three people who worked on it—Chris Given, Jen Thomas, Merici Vinton—have left government to join the Economic Security Project’s Future of Tax Filing Fellowship, where they will research ways to make filing taxes easier, cheaper, and more straightforward. They will be joined by Gabriel Zucker, who worked on Direct File as part of Code for America.

10'000 Hours/Getty Images

Damien has secretly worked multiple remote jobs, earning six figures on and off for years. To reduce his hefty tax burden, he's used several strategies, including maxing out his 401(k).

Damien, who works in IT support, is on track to earn $386,000 this year from three full-time remote jobs, two of which are 1099 contractor roles. The earnings from his contract positions flow to an LLC he established in 2022, which he elected to be taxed as an S Corporation. This helps him reduce the amount he owes in self-employment taxes, he said.

"Tax wise, it's a substantial difference," said Damien, whose identity was verified by Business Insider but who asked to use a pseudonym, citing a fear of professional repercussions. "I would have to guess it's tens of thousands of dollars that I'm saving."

Damien is among the Americans who have secretly juggled multiple remote jobs to boost their incomes and who have found strategies to reduce their tax burdens. Others make charitable donations and deduct business expenses from their incomes. Over the past two years, BI has interviewed more than two dozen "overemployed" workers who've used their additional earnings to travel the world, buy weight-loss drugs, and pay down debt.

Six job jugglers shared their experiences on the condition that pseudonyms would be used, for fear of professional repercussions. BI has verified their identities and earnings.

To be sure, what works for these job jugglers may not make sense for everyone. Tax professionals can provide advice for specific situations.

John, who works in IT, earned more than $300,000 in 2023 secretly working two remote jobs. His earnings from one contract job flow into his S-Corp, which he also uses to deduct business expenses, reducing his taxable income.

Business expenses include software subscriptions to ChatGPT, online programming courses, and the home office deduction, which allows him to deduct $5 per square foot of his home office.

"If I needed a new computer desk or chair, I'd run that through my business," said John, who is based in California.

To reduce his taxable income further, John said he donates to charitable organizations and makes significant 401(k) contributions.

Harrison also has an S-Corp, but his tax situation is more complicated. Harrison has six full-time remote jobs as a quality assurance professional in the IT sector and estimates he'll earn roughly $800,000 this year. He's built a team of seven workers who help him complete his duties.

Three of Harrison's jobs are contract roles, and he said the income for these flows into his S-Corp, which he said helps reduce his taxable income.

Lisa Greene-Lewis, a CPA and tax expert with TurboTax, said that S-Corps can help people legally reduce the amount they owe in self-employment taxes. Individuals are required to pay themselves a "reasonable" salary — which is subject to employment taxes — but then can take additional distributions from profits their companies generate that are not subject to these taxes. But she said there are limits to an S-Corp's tax benefits.

"In the eyes of the IRS, you could not pay yourself a majority of your business income to avoid more self-employment taxes," she said, adding, "If you pay yourself too little, the IRS could determine the amount they think you should be paid based on your business profit."

She added that S-Corp owners tend to have more tax prep-related expenses and must file a business tax return by March 1st, rather than the April 15 deadline for personal tax returns.

Despite the tax benefits that come with his S-Corp, Harrison said he tends to owe a significant amount of money in taxes. But he said he's still coming out ahead financially.

"Making more and paying more in taxes is better than making less and paying less," he said.

Adam earns roughly $170,000 annually secretly working two remote security risk jobs. He plans on reducing his taxable income this year by contributing $23,500 to his 401(k) — the maximum amount allowed by the IRS — and donating about $1,200 to charitable organizations.

However, not every job juggler is taking significant steps to reduce their taxable income. Daniel earns about $250,000 annually working two remote IT gigs in the finance industry. He said his main focus is withholding enough in taxes to ensure his tax payment isn't too steep.

"I've never had an issue with paying taxes," he said.

Kelly is on track to earn nearly $300,000 this year secretly working two full-time remote jobs as an engineer. She said her taxes aren't too complicated and finding ways to lower her taxable income isn't something she thinks too much about.

"I don't mind paying taxes on both jobs even if I owe," she said.

Do you have a story to share about secretly working multiple jobs or discovering an employee is doing so? Contact this reporter via email at [email protected] or Signal at jzinkula.29.