Trump's economic shock therapy

President Trump believes it's worth risking pain to achieve his medium-term goal of rewiring the U.S. economy. He is attempting a form of economic shock therapy, while accepting there could be collateral damage.

Why it matters: That willingness to shrug off risks of inflation or recession is now rattling financial markets and confidence — and has itself emerged as the biggest near-term economic risk.

The administration has embraced that the economic disruption it envisions could be painful.

- That adds to the risk that if the economy starts to falter — and it hasn't so far, at least according to the high-level data — no cavalry will be coming from Washington to contain the damage.

The big picture: Trump is seeking to rapidly undo a global economic order that has been decades in the making. Americans enjoyed the fruits of cheap goods made around the world, at the cost of a diminished domestic manufacturing base.

- He envisions an economy with many fewer bureaucratic paper-pushers and much more factory work.

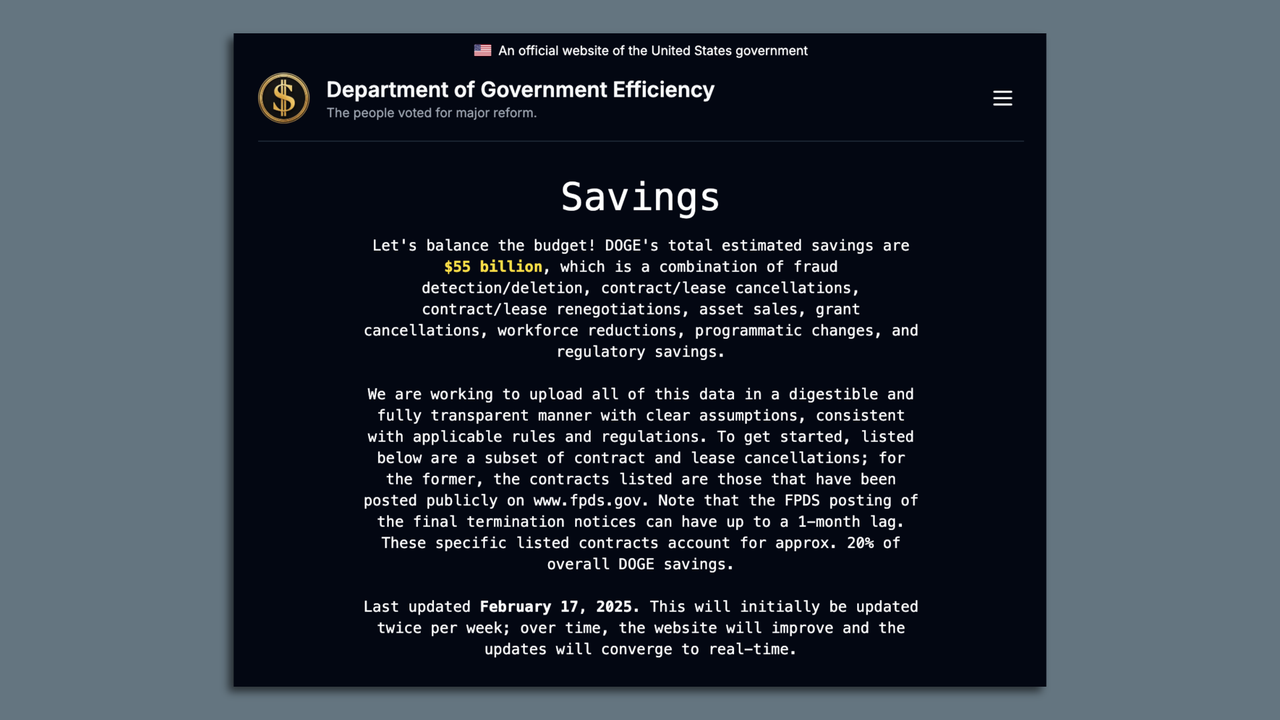

- He seeks to bring down the deficit while keeping taxes low — which only pencils out if there are major cuts to America's social welfare programs.

Coming "detox": "Could we be seeing this economy that we inherited starting to roll a bit? Sure," Treasury Secretary Scott Bessent said Friday on CNBC's "Squawk Box."

- "There's going to be a natural adjustment as we move away from public spending," Bessent added. "The market and the economy have just become hooked ... We've become addicted to this government spending and there's going to be a detox period."

Context: The mainstream view among Wall Street economists and Fed officials is that Trump inherited an economy that was in basically sound shape.

- The unemployment rate was low (4% in January). Inflation was far below its recent highs (2.5% for the 12 months ended January).

The Trump team rejects that view completely, arguing that Biden handed over an economy so terrible that it demands a wholesale rebuild. "Biden left him a pile of poop," as Commerce Secretary Howard Lutnick put it on Bloomberg TV last week.

- Trump, in this view, inherited an economy in which a seemingly healthy job market is, in fact, illusory.

- It's true that the federal government has been running budget deficits that are higher — 6 to 7% of GDP — than ever before seen outside of wars or economic crises.

- And job growth in recent months has indeed been fueled by hiring in state government employment and health care. The private sector has been in "recession," Bessent has argued.

State of play: Administration officials are increasingly acknowledging the potential costs of the adjustment.

- If trade wars mean U.S. farmers get shut out of foreign markets they've spent decades building, well, there "may be a little bit of an adjustment period" as Trump said this in this week's Congressional address.

- What if the stock market drops, hitting Americans' retirement accounts? "I'm not even looking at the market, because long term the United States will be very strong," Trump said this week.

Reality check: Economic change is often painful; just ask the U.S. manufacturing workers who lost their livelihoods amid the China shock of the early 2000s. Trump wants to make changes to the fabric of the global economy at hyperspeed — which comes with political peril.

- Americans really like cheap stuff (though Bessent says that's not the American Dream). Witness the outpour of anger at the inflation and shortages that erupted in the aftermath of the pandemic.

- It will likely take time for laid off government workers to find their way into new work in growing sector, during which time they are on the jobless rolls.

The bottom line: Americans who voted for Trump seeking a return to the low-inflation, steady-eddy conditions the prevailed in 2019 may be in for a rude awakening.

- But the president and his advisers believe they have a mandate for big-time change, whatever the costs.