Trump tariffs, policies fray U.S. relationship with allies

America's fraying relationship with longtime allies is driving global economic shifts that were unthinkable just months ago.

Why it matters: Policy changes in the U.S. are rippling beyond its borders.

- Some of the world's biggest economies are in the midst of their own policy regime changes — pledging investments and adjustments in response to President Trump that could outlast him.

In Europe, the catalyst is the Trump administration's threat to pull back U.S. protection of European Union borders, as well as looming tariffs that could crush the already-ailing economy.

The intrigue: Europe is racing to adjust with plans that will play out over decades — a type of response not seen in Trump 1.0.

- Trump took office just as European leaders acknowledged the need for changes to reinvigorate its stagnant economy.

- But it also might be a sign of leaders expecting that Trump-style policies might stick even after he leaves office.

What they're saying: "Whereas Trump's first four years the Europeans viewed him as an accident, I think they see now he's no accident," Gordon Sondland, the former U.S. ambassador to the EU under Trump, tells Axios.

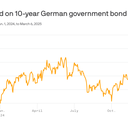

What's new: Germany's likely next chancellor, Friedrich Merz, announced plans to loosen the so-called "debt brake" that capped the deficit at 0.35% of GDP. This would let the country borrow billions for defense and infrastructure spending.

- "In view of the threats to our freedom and peace on our continent, the rule for our defense now has to be 'whatever it takes,'" Merz said at a press conference this week.

- Merz invoked an economically significant phrase for Europe: In 2012, then-European Central Bank president Mario Draghi said he would do "whatever it takes" to save the euro amid a debt crisis.

For proof of the historic nature of Germany's shift, look to the response in the bond market: Yields on the 10-year bund jumped more than 30 basis points in a single day, raising the nation's cost of borrowing.

What to watch: The scale of investment could help transform Europe's largest economy at a perilous time. It has been contracting since 2023, and Trump's proposed tariffs — set to take effect next month — could wreak havoc on its manufacturing industry.

- "Europe is being rocked by giant Trump shocks that have generated an equally massive response," Evercore ISI's Krishna Guha wrote in a client note Wednesday.

- "These are weeks when decades happen," Guha adds.

/2025/02/24/1740405093695.gif)

/2025/02/24/1740405093695.gif)