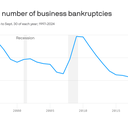

Number of bankruptcies rise thanks to the Fed

If capitalism without bankruptcy is like Christianity without hell, as former astronaut and Eastern Airlines CEO Frank Borman famously put it, then the U.S. over the past decade or so has been a joyous church indeed.

Why it matters: We're now beginning to see signs that the days of very few bankruptcies might be coming to an end, thanks in large part to the Fed.

How we got here: The financial crisis of 2008 to 2009 saw a sharp rise in bankruptcies, as you'd expect.

- It also caused the Fed to cut interest rates to zero and to keep them there for many years.

- It led bank regulators to get stricter about the amount of risk they allowed banks to take on, even as borrowers also started to get worried about the consequences of having too much debt.

- The result was a years-long decline in bankruptcy filings, as smaller debts became easier to refinance in an easy-money era.

Where it stands: A recent uptick in the numbers suggests that era might have ended with the Fed rate hikes of 2022. As CEA chair Jared Bernstein tells Axios, "we know this variable is pretty highly elastic to rate rises."

The big picture: Bankruptcy — a process that wipes out debts and allows fresh starts — is a necessary part of any dynamic economy.

- Fewer bankruptcies isn't always a good thing. It can be a sign of excessive risk aversion on the part of both lenders and borrowers, a paucity of what John Maynard Keynes characterized as "animal spirits."

- As University of Illinois law professor Robert Lawless notes, bankruptcy filings are not a good measure of the health of the economy. "Note how bankruptcies declined as the economy went into recession in the early 2000s," he said of the chart above.

By the numbers: Bankruptcy filings by companies with assets or liabilities greater than $2 million if they're public (or $10 million if they're private) rose to 694 in 2024. That's up 9% from 2023 and up a whopping 87% from a record low of 372 in 2022, per S&P Global.

- Overall, business bankruptcies in U.S. courts rose to 22,762 in 2024, up 33% from 2023 and up 73% from 2022.

- Those numbers are less precise than they seem, since the default setting on most bankruptcy-filing software is "consumer" rather than "business" and many business filers don't check that box.

- Meanwhile, many large corporate bankruptcies involve simultaneous filings from hundreds of subsidiaries, which can result in the numbers being exaggerated.

Yes, but: The absolute number of bankruptcies is still low, even after the recent increases.

- In 1997, for instance, there were 54,252 business bankruptcy filings, and 6.1 million business establishments in the U.S., for a ratio of 0.9%.

- By 2024, that ratio had fallen to 0.3%.

The bottom line: When rates rise, they bite harder. But an economy with more bite isn't always a bad thing.