Quantum computing stock bubble bursts after Nvidia CEO warning.

Shares in the ultra-hot quantum computing sector plunged on Wednesday after Nvidia's CEO said useful quantum computers were decades away.

Why it matters: Quantum computing stocks have been on a ferocious run, with some names rising almost 20x in the last year.

Driving the news: Nvidia held a Q&A with Wall Street analysts on Tuesday, during which CEO Jensen Huang was asked about the growth path for the still-nascent technology.

- "And so if you kind of said 15 years for very useful quantum computers, that'd probably be on the early side. If you said 30 is probably on the late side. But if you picked 20, I think a whole bunch of us would believe it," Huang said.

- Nvidia's dominance in AI computing gives Huang's technology forecasts outsized impact — and his comments tend to move stocks.

By the numbers: Shares in Rigetti Computing plunged 46% in early trading Wednesday. Before that collapse, the stock had risen more than 1,800% in just one year.

- Shares in Quantum Computing Inc. also fell 45%, while shares in IonQ dropped more than 42%.

- Together, the losses exceeded $4 billion in market capitalization.

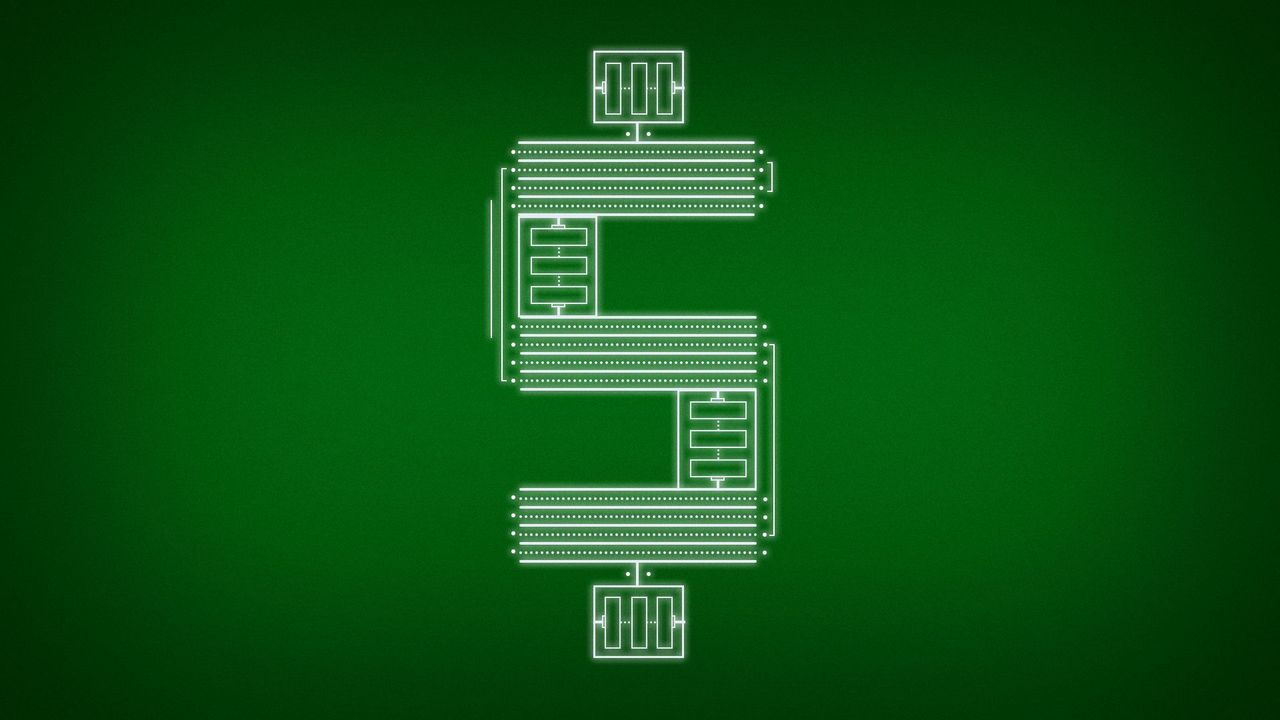

Context: Quantum computing is bleeding-edge stuff, applying the principles of quantum mechanics to perform computing tasks far too difficult for traditional computing.

- As MIT scientists describe it, traditional binary computers use electrical signals that can be either 0 or 1. Quantum computing uses subatomic particles that can be both simultaneously. It sounds like a small difference but the power is exponential.

- Google said last year its new quantum computing chip, code named Willow, did computations in five minutes that would take today's supercomputers 10 septillion years.

- But as Google itself points out, Willow's achievement is little more than a "convincing prototype" that offers a "strong sign" quantum systems can be built at scale.

Editor's note: This report has been updated with early Wednesday trading levels for stocks.