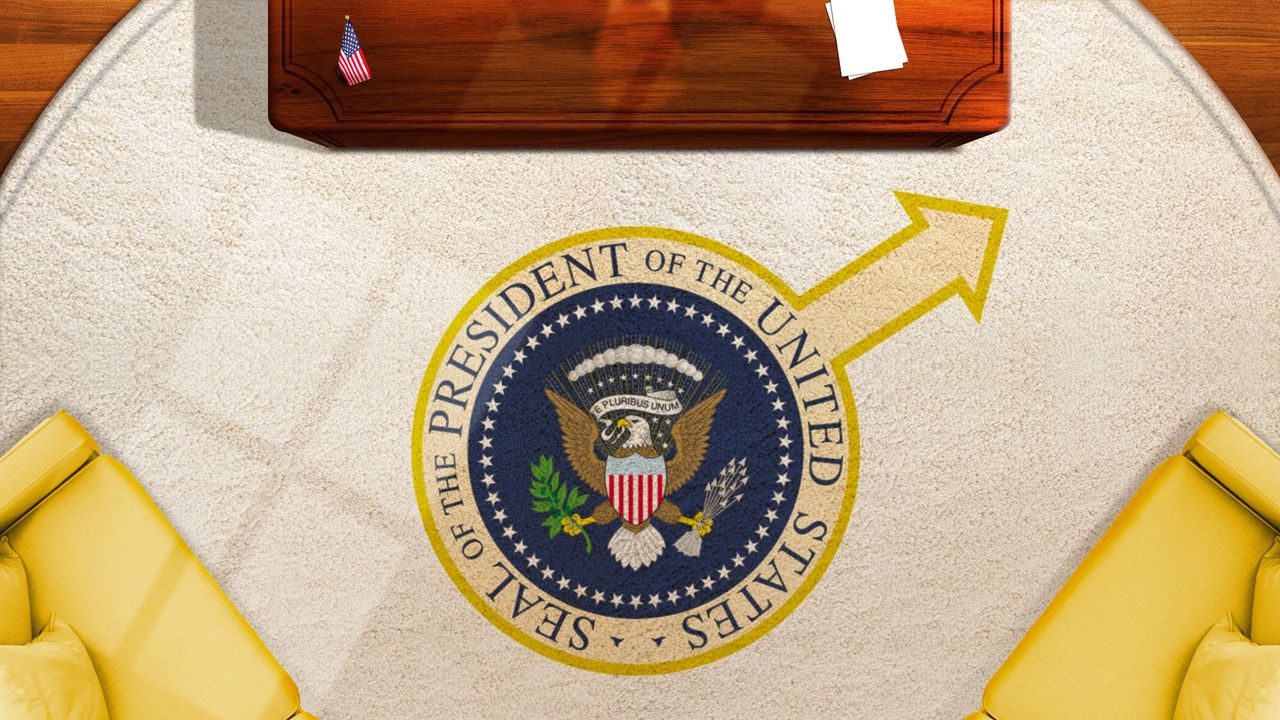

Behind the Curtain: Trump plays with fire — by choice

They did it delicately, privately and belatedly. But some Cabinet members and top confidants warned President Trump that two pillars of his flood-the-zone strategy could backfire: tariffs and Elon Musk's budget-gutting.

Why it matters: Both moves hacked off allies — some Hill Republicans and Cabinet officials with cuts, Canada and Mexico with tariffs — and created the impression and reality of uncertainty or outright chaos.

Now, the public is weighing in:

- Markets hate uncertainty and chaos. The S&P 500 is down 6.4% since Inauguration Day, and 3% since Election Day — one of the worst-performing major indices in the world. Most market signals are negative — partly because of a tech meltdown that's not entirely Trump-driven. But the uncertainty is the critical element. The uncertainty is the point.

- Consumers are already losing confidence and pulling back on spending, weakening a key engine of the economy.

- Several polls show a slump in Trump's popularity since he took office and launched his shock-and-awe plan to remake the U.S. government and the world order.

Today is Day 51 of Trump's term — halfway through the opening 100 days.

- "Ever since the election, Trump has been the master of the narrative," a Trump adviser told Axios' Marc Caputo. "We won every day. But this stock market fall is just different, no control. But it's just a detox — it'll get better."

A senior White House official tells us: "The market isn't great, not gonna lie. But the vibes are still good otherwise."

- Another White House official said Trump and his team "are adept at playing the long game, and we will not be dictated by a snapshot in time when there are so many indicators that show we're building a strong economy with staying power."

- The White House on Monday republished a Reuters list of a dozen companies looking at opening or expanding in the U.S. as tariffs loom.

What we're hearing: House and Senate Republicans are hyper-focused on avoiding a government shutdown at midnight Friday. And they're hopeful the stock market will trend back upward.

- "If the stock market looks like this in three weeks, we've got a problem," said a top consultant to Republican Senate and House candidates. "There's time. It's early."

- Sen. Rand Paul (R-Ky.) posted on X with a bear-red graphic of Monday's indexes: "The stock market is comprised of millions of people who are simultaneously trading. The market indexes are a distillation of sentiment. When the markets tumble like this in response to tariffs, it pays to listen."

Behind the scenes: Trump's team remains confident and aggressive, and contends not a minute has been wasted. The number of migrants trying to reach the U.S. by trekking through the Darién Gap jungle into Central America plunged 99% last month from February 2024, Bloomberg reported Monday.

- Trump and his aides are taking risks with eyes wide open — and we're told they're determined to persevere. They think the first 50 days couldn't possibly have gone better. An emboldened Trump is leaning into his instincts on every front.

- Trump's team cares most about the MAGA base, which is beyond delighted with the pace and scope of his move-fast-and-break-things approach.

Trump and his advisers recognize "that changing the globalized economic system, which has deindustrialized the United States, will create friction in the real economy," a top Republican insider told us.

- "To rebuild the U.S. civilian and defense industrial base that the globalists gave away to China will cause economic and market dislocation in the short term," the insider added. "It's a play for long-term results — like Reagan on deficits to win the Cold War."

Reality check: Some Cabinet members and congressional Republicans fear this painful "transition," Trump delicately labeled it Sunday in an interview with Fox News' Maria Bartiromo, could stall his agenda.

- It was that quote — Trump refusing to rule out a recession — that helped fuel Monday's market swoon as fears rose about a U.S. economic slowdown and the possible pocketbook effects of tariffs.

- "This big sell-off feels ugly, it feels nasty," Drew Pettit, an equity strategist at Citigroup, told the Financial Times. "We were coming off very high sentiment and very high growth expectations. All of this is just recalibrating to the new risks that are in front of us."

Between the lines: There's a messaging gap that's confusing the market, too. The same morning Trump was hedging on a possible recession, Commerce Secretary Howard Lutnick was on NBC's "Meet the Press" guaranteeing: "There's going to be no recession in America."

- Investors like one message from government — not a menu.

Axios' Ben Berkowitz and Marc Caputo contributed reporting.

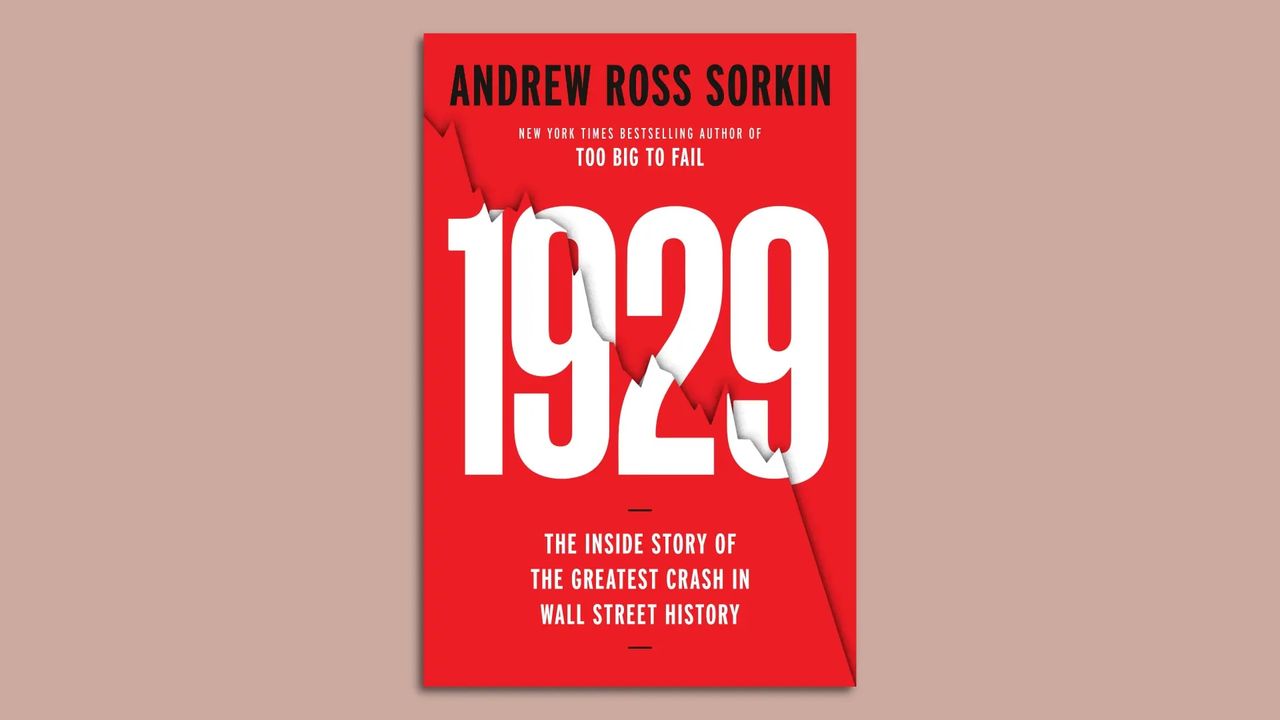

- Go deeper: The real "stagflation" risk, by Axios' Neil Irwin and Courtenay Brown.