American Airlines briefly halts all flights on Christmas Eve

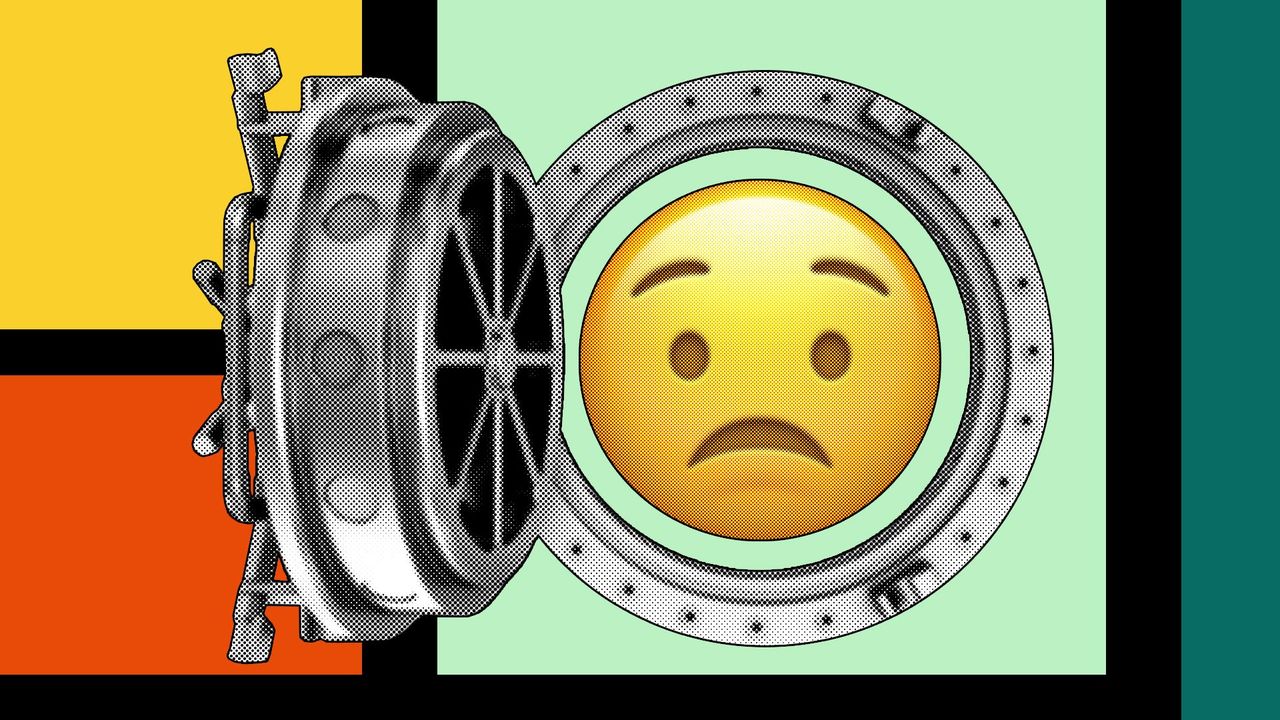

All American Airlines flights nationwide were halted for about an hour Tuesday morning after what the airline called a "technical issue."

Why it matters: The nationwide outage snarled early traffic on Christmas Eve for the world's largest carrier.

Catch up quick: The FAA issued a nationwide ground stop for all American flights at the airline's request as of 6:49 a.m. ET.

- It was cancelled at 7:50 a.m. ET.

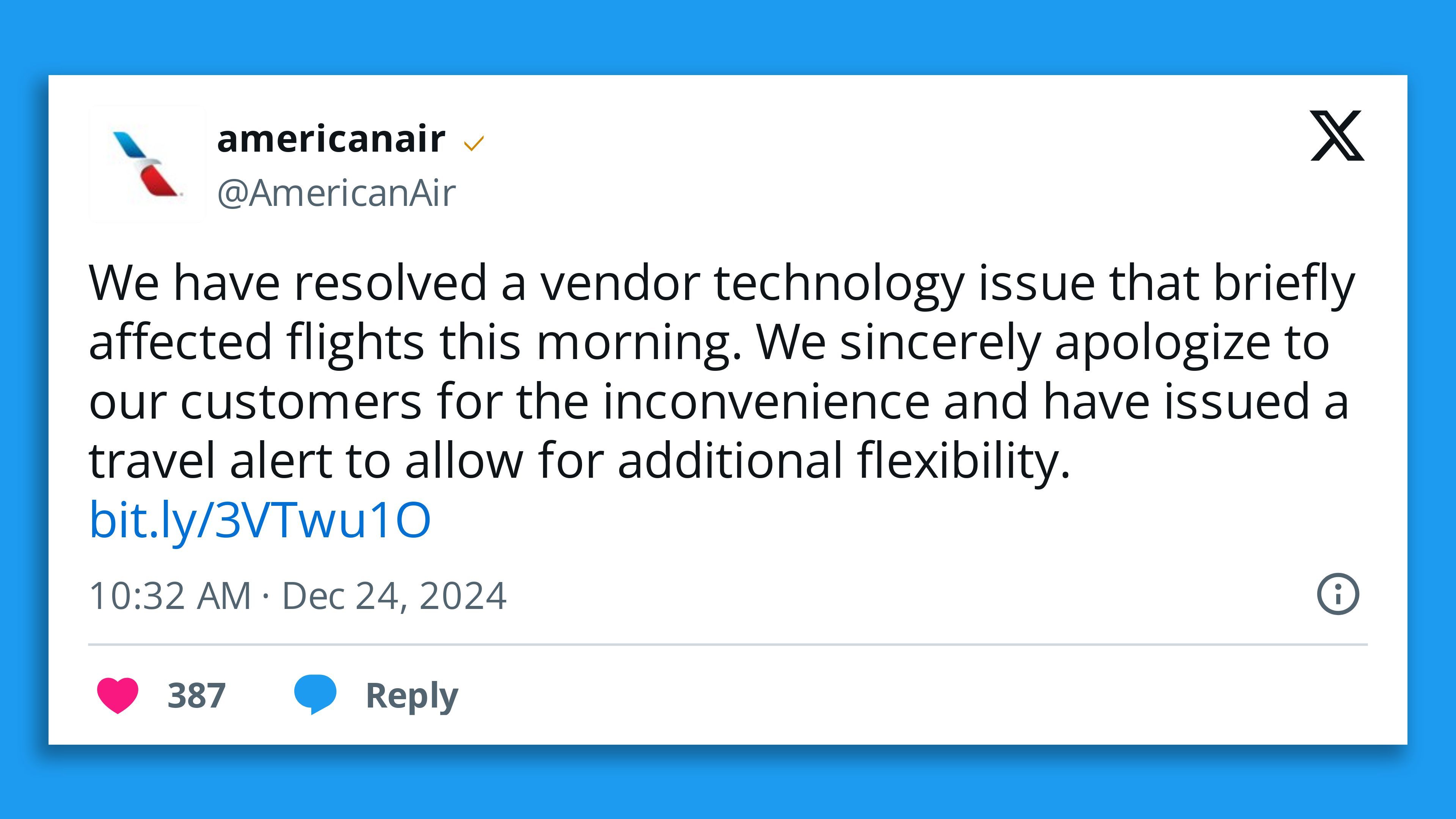

What they're saying: "A vendor technology issue briefly affected flights this morning. That issue has been resolved and flights have resumed," the airline said in a statement.

- The issue "impacted systems needed to release flights," American added.

- Multiple passengers posted on X that their planes had been forced to return to gates, and in some cases all passengers had to get off.

Between the lines: Even a temporary morning pause can throw an airline's daily schedule into chaos.

- FlightAware showed just over 300 flight delays nationwide around 8 a.m. ET, mostly impacting East Coast airports like New York's John F. Kennedy International and Boston's Logan International Airport.

- By 6pm ET, nearly 650 flights had been delayed. However, this was mostly at Dallas Fort Worth International Airport, which experienced delays due to severe weather.

- Christmas Eve is one of the lightest air travel days of the holiday season, though nearly 2 million people flew on Dec. 24 last year, per the TSA.

The intrigue: On Monday, American touted its recent performance in a note to reporters, boasting it had more on-time departures than any competitor since the holiday season started.

Flashback: American isn't the only airline to have suffered holiday snafus.

- Southwest Airlines was fined $140 million and spent months rebuilding customers' trust after an extended Christmas week meltdown in 2022.

Editor's Note: This story has been updated with additional statements from American Airlines and more details from FlightAware.