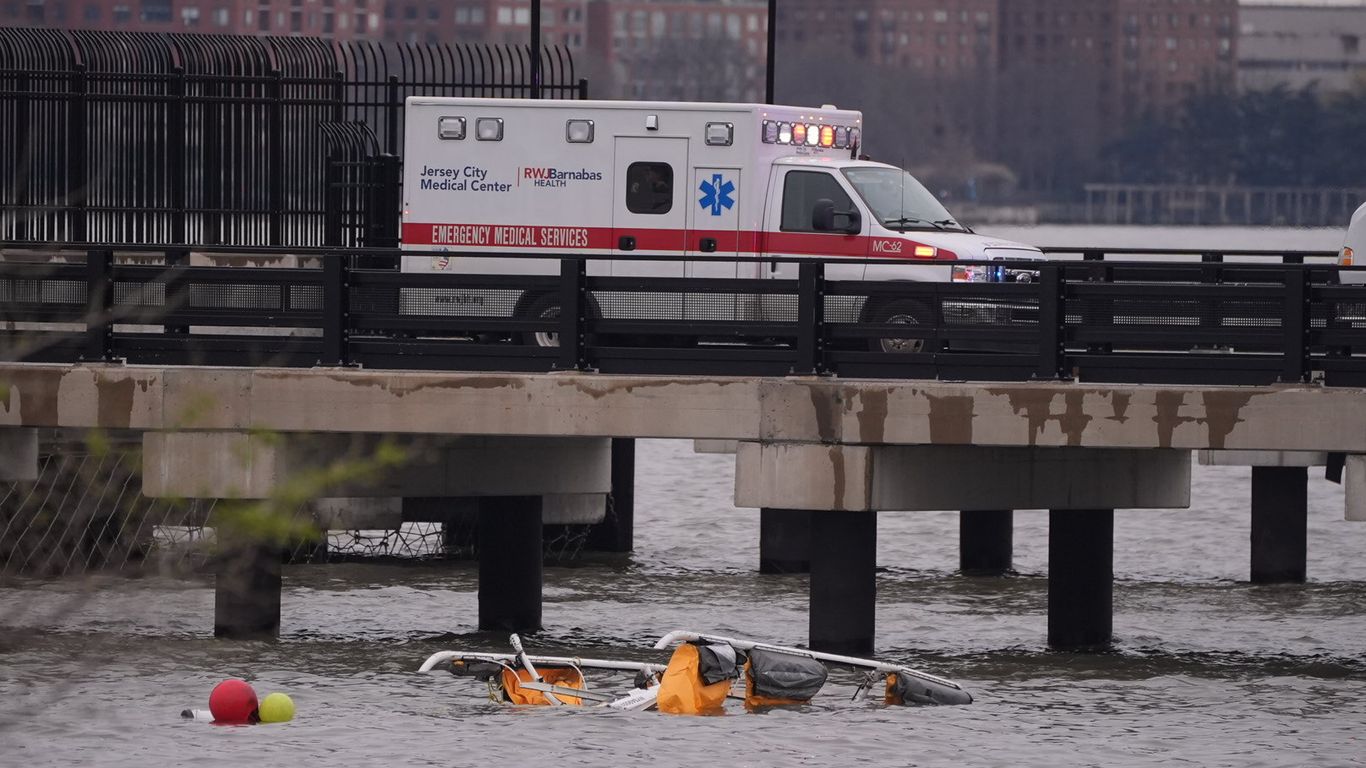

Xi's counterpunch: How China will ensure the trade war hurts the U.S.

Chinese President Xi Jinping has no shortage of pressure points to ensure Americans feel the pain from President Trump's superpower trade war.

The big picture: China has thus far imposed 84% tariffs in response to Trump's levies, which are now up to an eye-watering 145%. But ever since trade war 1.0, Beijing has been developing an array of tools that it's now putting to use.

- Here are seven ways China can punch back as Trump continues to dial up the pressure.

1. Hit consumers in the wallet

Xi doesn't even need to lift a finger to ensure Americans are hurt by the trade war — Trump's own tariffs may take care of that.

- China's factories produce the vast majority of the toys, cell phones and many other products Americans buy. From fast fashion to gaming consoles, things will get more expensive.

Between the lines: Trump has claimed the tariffs will produce a U.S. manufacturing boom that eliminates the reliance on made-in-China products. Even if that's plausible, consumers are likely in for years of pain in the meantime.

- However, Trump has also suggested he's open to negotiations with Xi, which could lead to a trade truce much sooner.

- Xi certainly has incentives to seek a deal, given the havoc the tariffs will wreak on China's already vulnerable economy. But a long-term trade war could arguably pile more political pressure on Trump than on him.

2. Punish the farmers (and more)

Any American whose livelihood depends on selling into the Chinese market is likely panicking right now — whether the product in question is oil, airplanes or soybeans (three of the top U.S. exports).

Flashback: Trump had to bail out American farmers to the tune of $28 billion during trade war 1.0, when tariff levels were far lower.

- Now, the world's largest market for soybeans is already turning away from the U.S. and toward Brazil.

What to watch: Much the same can be expected for other products. While China exports more to the U.S. than vice-versa, China is still the #3 export market for U.S. products.

- The inability to compete in China will damage or doom a broad range of U.S. companies if the trade war drags on.

3. Target individual U.S. companies

China added twelve U.S. firms to an export control list this week — restricting what they can ship out of China — and added six defense tech and aviation firms to an "unreliable entity list" that bans them from doing business in China.

- Beijing also announced an antitrust investigation into chemicals giant DuPont. That follows previous announcements of probes into other blue-chip American companies like Google and Nvidia.

China has honed that toolkit — export controls, blacklists and investigations — to target individual U.S. firms over the past several years.

- Many of America's biggest companies are deeply reliant on the Chinese market. If Beijing ramps up those tactics, Trump can expect to hear from CEOs nervous about being cut out of China.

4. Cut off supplies of rare earth minerals

China last week further restricted exports of rare earths — a sector it dominates — in response to Trump's tariffs.

- The Trump administration is scrambling to source minerals from elsewhere. But for now, the U.S. is heavily reliant on China for key inputs for products ranging from semiconductors to missiles to wind turbines.

Friction point: Banning the export of certain rare earths outright could cripple production in critical industries.

- However, like almost everything in this trade war, it would hurt China too by eliminating demand and causing shortages of products (like high-end chips) that China also needs.

5. Selling U.S. debt

On the topic of things that would hurt the U.S. but also ricochet back onto China, there's the "nuclear option" of dumping the $761 billion in U.S. bonds held by Beijing.

- Most economists doubt Xi would pull that lever given the risks to the Chinese and global economies, but even having that capability gives him leverage.

6. Devaluing the yuan

Another potential economic lever is a sharp devaluation of China's currency, which would help boost China's exports and further diminish the ability of U.S. firms to compete in the Chinese market.

- For now, though, Beijing has indicated it wants to keep the yuan stable — and to press countries to conduct more trade in yuan, rather than dollars.

7. Freezing out Hollywood

China is a key market for U.S. films, sports leagues, and other entertainment products, and Beijing hasn't been shy about using that leverage to influence what public figures say or what appears on screen.

- China's film administration said Thursday that it will "moderately reduce" approvals for Hollywood films. There's also chatter among influential Chinese bloggers about a full ban, according to Bloomberg.

- Shares in U.S. entertainment companies are sinking on those reports.

The bottom line: Trump knows that ratcheting up the trade war will squeeze China's economy, which remains heavily reliant on the U.S. But Xi knows it's a two-way street, and has plenty of options for ensuring Americans feel the squeeze, too.