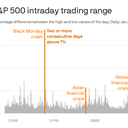

Two days of historic volatility rock the markets

The volatility we've seen in the markets this week is not unprecedented, but it's extremely rare, and has happened only four previous times since 1978.

Why it matters: This kind of noise is a sign that we've now entered a world of radical uncertainty, and that the markets are finding it impossible to do their main job, which is price discovery.

Flashback: Last Thursday, as the markets reacted to the tariffs unveiled the previous evening, the S&P 500's intraday trading range — the gap between the high and low points of the trading day — was a relatively modest 2%.

- Stocks opened down 3.1% and ground lower to close down 4.8%, in what looked like a large but orderly decline.

Where it stands: This week's trading has been very different, marked by wild intraday swings. The S&P 500% rose 8.3% in a mere 34 minutes on Monday. On Tuesday it opened up 4% and closed down 3%.

Between the lines: Stock market trading is increasingly dominated by multi-strategy "pod shops," and at the heart of most of them is "some sort of quant strategy," as hedge fund manager Krishna Kumar recently told the Odd Lots podcast.

- What that means in practice is a lot of short-term trades and a lot of leverage, both of which work to magnify both returns and volatility.

- Meanwhile, fundamentals-based long-term investors have essentially zero visibility into how the current tariff drama is going to play out.

- Without any strong conviction one way or the other, they're now hesitant to take losses or buy the dip, and they have therefore effectively ceded the role of price discovery to the algorithms.

What's next: What we haven't yet seen, says David Rolley, co-head of fixed income at Loomis Sayles, is "capitulation" by those real-money investors.

- While Rolley does see international investors in particular rotating out of U.S. assets, he says that process is likely to take years rather than days.

The bottom line: Previous bouts of massive volatility were associated with huge financial dislocations, or, in the case of the pandemic, the entire planet pretty much coming to a stop.

- This time around, though, the chaos is intentional.