Tariff worries, Trump cuts signal emerging economic growth risks

They're mere tremors at this point, not an earthquake. But worries about the outlook for U.S. economic growth are starting to mount.

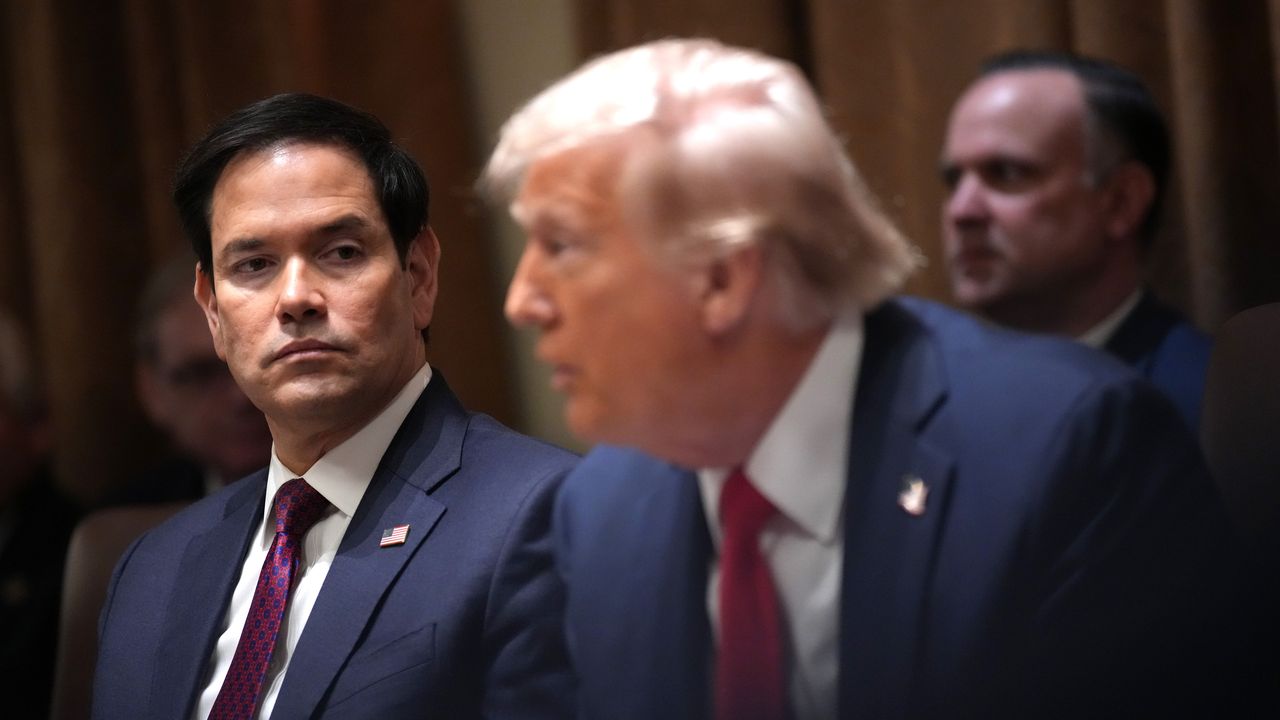

Why it matters: On-again, off-again tariffs on major trading partners have added uncertainty to the business outlook, making hiring and investment decisions more complex.

- Consumers whose incomes depend on the federal government — whether as employees, contractors or benefit recipients — face the brunt of Trump administration cutbacks. This risk could make them more cautious in their spending.

State of play: Evidence these forces will restrain overall growth is only being seen in soft data so far — surveys of business and consumer sentiment, for example. The hard data shows little evidence of deterioration in spending, investment or hiring.

- But new growth worries have coincided with a steep drop in Treasury yields since the start of the year, which tends to reflect bond investors' growth expectations.

What they're saying: "With 3 million federal employees potentially worrying about their jobs and 6 million federal contractors worrying about their jobs, the risks are rising that households may begin to hold back purchases of cars, computers, washers, dryers, vacation travel plans, etc.," wrote Torsten Slok, chief economist at Apollo Global Management, in a note out Thursday morning.

- "We remain bullish on the economic outlook, but we are very carefully watching the incoming data for signs if this is an inflection point for the business cycle," he added.

Kansas City Fed president Jeff Schmid said in a speech Thursday morning that "discussions with contacts in my district, as well as some recent data, suggest that elevated uncertainty might weigh on growth."

- "This presents the possibility that the Fed could have to balance inflation risks against growth concerns."

Of note: Clients of one major bank are asking if it's time to think about using the word "recession" again.

- "As US data soften, clients have started asking us about the prospect of a US recession," wrote Barclays' Ajay Rajadhyaksha and Marc Giannoni in a note Wednesday. "We think the odds are still low, but have clearly risen."

- "A US recession remains improbable, but is no longer unthinkable in the coming quarters," they added.

Reality check: Over the last few years, amid Fed rate hikes and geopolitical strife, predictions of a major slowdown or recession have repeatedly been wrong.

- The new administration's policies also may be creating tailwinds from deregulation and the prospect of tax cuts.

The bottom line: The U.S. economy is a mighty tanker ship, almost always moving forward. But the number of warning signs that it could be pushed off-course is rising.