Trump and the Fed likely face an uphill battle to lowering inflation

Bond markets are betting that inflation will stay elevated in the years ahead, and some evidence from business surveys and forecasters points in the same direction.

Why it matters: This belief suggests the Trump administration and the Federal Reserve face a headwind in securing a return to low inflation — concerns that have escalated just in the last few weeks, as the president has threatened tariffs on a variety of U.S. trading partners.

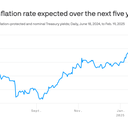

State of play: The gap between interest rates on standard U.S. Treasury securities and inflation-protected bonds gives a window into how much bond investors expect prices to rise in the future. That gap, known as the breakeven rate, has been on a tear in recent weeks.

- Bond prices now imply 2.7% annual Consumer Price Index inflation for the next five years, up from 2.4% at the start of 2025 and 1.95% as recently as last summer.

- The only times five-year breakevens have been higher, in a data series that dates to 2003, were during the peak of the 2022 inflation surge and a brief period in 2005.

There are hints in surveys that it isn't just bond traders who are revising their inflation outlook.

- The Philadelphia Fed's survey of manufacturers in its region showed that indexes for input prices and prices they can charge both rose to their highest levels in more than two years. The New York Fed's survey of manufacturers showed the same.

- The median professional forecaster upped its projection of 2025 CPI inflation to 2.8% from 2.4% three months ago, per a separate Philly Fed survey.

Between the lines: The Fed will be reluctant to cut interest rates again if the higher inflation expectations look to become more widespread and entrenched.

Yes, but: Longer-term measures of inflation expectations look less worrying. The bond market breakeven for annual inflation, in a window of five to 10 years from now, is down slightly this year — at levels consistent with the Fed's 2% target.

Reality check: The simmering inflation occurs against a general backdrop of business optimism for growth. CEOs are broadly bullish on the outlook for the years ahead, and the stock market is scraping new highs.

- The Conference Board's survey of CEO confidence, released Thursday morning, rose to its highest level in three years.

- The improvement "was significant and broad-based," Stephanie Guichard, a senior economist at the Conference Board, said in the release.

- "CEOs were substantially more optimistic about current economic conditions as well as about future economic conditions — both overall and in their own industries."