Post-Trump election boost fades: Consumer confidence drops in December

American consumers are not feeling the holiday cheer: concerns about what's ahead for the economy shot up as tariffs loom, according to a barometer of consumer confidence released on Monday.

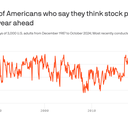

Why it matters: The post-election bump in consumer confidence in November now looks like a blip, at least by one measure.

- Long-running economic pessimism lives on despite solid economic conditions — a sign the next administration might see consumer moods at odds with economic indicators.

What they're saying: "Compared to last month, consumers in December were substantially less optimistic about future business conditions and incomes," says Dana Peterson, chief economist at the Conference Board, the group that has measured consumer confidence for decades.

By the numbers: The Conference Board's consumer confidence index fell by 8.1 points this month, reversing the prior two months' gains and remaining at the somewhat depressed level that has prevailed in the past two years.

- December's drop was overwhelmingly a result of more pessimism about income, business and labor market prospects in the months ahead.

- A sub-index that measures consumer expectations fell almost 13 points last month alone, "just above the threshold of 80 that usually signals a recession ahead," the Conference Board said in a release.

The intrigue: It's more likely now than ever before that politics will skew measures of confidence. That is why Republicans' economic outlook surged after the election and Democrats' view soured, with little change in the actual economic backdrop.

- The Conference Board does not report consumer confidence by political party. But the group said consumers mentioned politics more often this month as the key factor affecting how they view the economy.

- Mentions of tariffs, the centerpiece of Trump's agenda, continued to rise. Roughly 45% of consumers expected tariffs to raise the cost of living, while 21% said it would create more jobs.

Between the lines: Worries about the inflationary fallout from potential tariffs has not translated into diminished buying plans for cars, the group said — among the items that could be most impacted by Trump's tariff plans.

- Plus, the average inflation expectation in the year ahead in the survey was steady at 5%, the lowest since March 2020.

- Inflation remains somewhat elevated, with little progress in recent months toward dropping further — the reason why the Federal Reserve does not expect to reduce interest rates in 2025 nearly as much as it did earlier this year.