The real message of the Moody's downgrade

The U.S. government is spending far more than it takes in as revenue, causing ever-rising debt — and there is no sign that will change anytime soon.

The big picture: Those facts are well-known to anybody who has taken a cursory look at the government's books. But Moody's decision to downgrade the U.S. credit rating Friday is the latest reminder that this precarious fiscal standing comes with real risks.

- Moody's — the last of the three major raters to downgrade the U.S. from its once-pristine credit rating — is acknowledging that U.S. policymakers may have less room to maneuver in future recessions or crises, in light of the massive existing pile of debt.

- It is one more sign that an era in which the U.S. government could borrow seemingly limitless amounts, without experiencing the cost of higher interest rates and inflation, may have come to an end.

Zoom out: Ratings from firms like Moody's help determine how much companies, municipalities, and even sovereign nations must pay to borrow money.

- The downgrade implies that the U.S. government is a bigger credit risk than it seemed, which in theory could make some investors demand higher interest payments to buy government bonds.

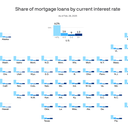

- That would ripple through into higher borrowing costs across the economy, including for home and auto loans.

- In practice, most buyers of Treasury bonds aren't doing so based on credit rating firms' assessment, so the direct impact on markets was limited Monday.

State of play: The downgrade came as congressional Republicans move forward on their plan for major tax cuts, which independent fiscal watchdogs believe would increase the deficit by trillions over the coming decade.

- Compared to past episodes when the government has taken on deficit-widening initiatives, the new budget bill arrives at a moment of higher debt and higher interest rates.

- And it comes after global investors have already seemed jittery about the safety of U.S. assets amid the trade war, resulting in higher interest rates and more risk to the ability to continue financing debts.

White House officials emphasize that they inherited sky-high deficits from the Biden administration and say that their policy mix — including deregulation, tariffs, DOGE spending cuts, and pro-growth aspects of the budget bill — will help bring them down.

- "I do want to assure everyone that the deficit is a very significant concern for this administration," top White House economist Stephen Miran told reporters Monday.

- "We're determined to bring it down and to undo the damage to the fiscal health of the United States that was wrought by the Biden administration and its reckless policies."

What they're saying: "Yes, this Moody's action is largely symbolic, and it reflects information we already know," notes Callie Cox, chief market strategist at Ritholtz Wealth Management.

- "But it's a headline that came at a wildly inopportune time for the fixed-income market," which is to say the multi-trillion dollar market for government bonds.

- "Moody's picked a moment when the world is second-guessing U.S. debt, Congress is arguing over government budget proposals, and the policy uncertainty" around long-term Treasuries is the highest in years, she adds.

The bottom line: "The government deficit isn't a problem until investors think it is," says Cox. "And they're increasingly telling us that the deficit is a problem."